Case Study: Cutting Operational Drag by40%

I. The Challenge: The Cost of Process Covariance

The client, a high-growth B2B logistics services firm with an annual revenue of $120

million, was experiencing a critical constraint on its enterprise valuation. Despite a

profitable core business, the firm was suffering from acute systemic entropy—a state

where internal process friction consumed capital and eroded customer lifetime value.

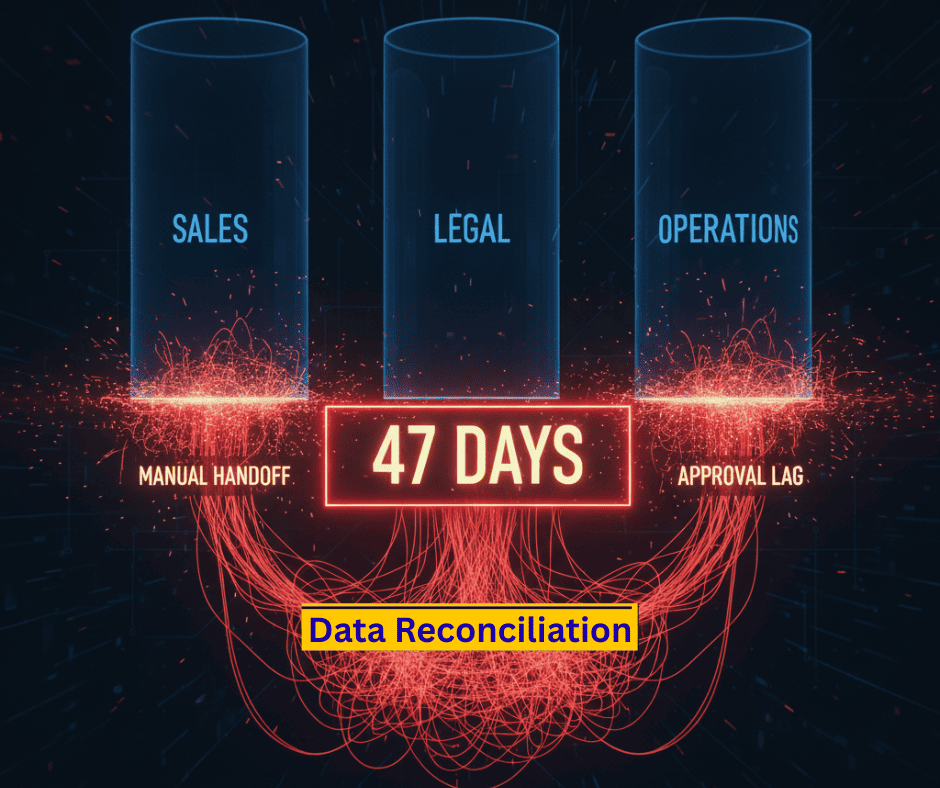

The single most corrosive point of failure was the Sales-to-Fulfillment handoff, which

exhibited a mean time of 47 days from contract signing to initial service delivery. This

extended latency was a direct measure of operational drag, resulting in a high client

churn rate and excessive administrative rework. The underlying issue was a high

degree of process covariance between the Sales, Legal, and Operations silos, where

the variability in one function compounded the stasis in the next, creating a non-linear

financial penalty. The firm was structurally incapable of scaling without a fundamental

architectural intervention to eliminate this systemic friction.

II. The Elevion Intervention: Architecting Systemic Flow

Elevion was engaged to apply the Architecting Operational Alpha Playbook, moving

the client from a state of systemic entropy to one of continuous, self-correcting flow.

The intervention began with a rigorous diagnostic phase utilizing Causal Flow

Mapping to objectively locate the points of maximum Process Covariance. This

analysis revealed that 85% of the 47-day drag was attributable to three unaligned,

human-in-the-loop handoffs. The solution was the engineering of a Self-Optimizing

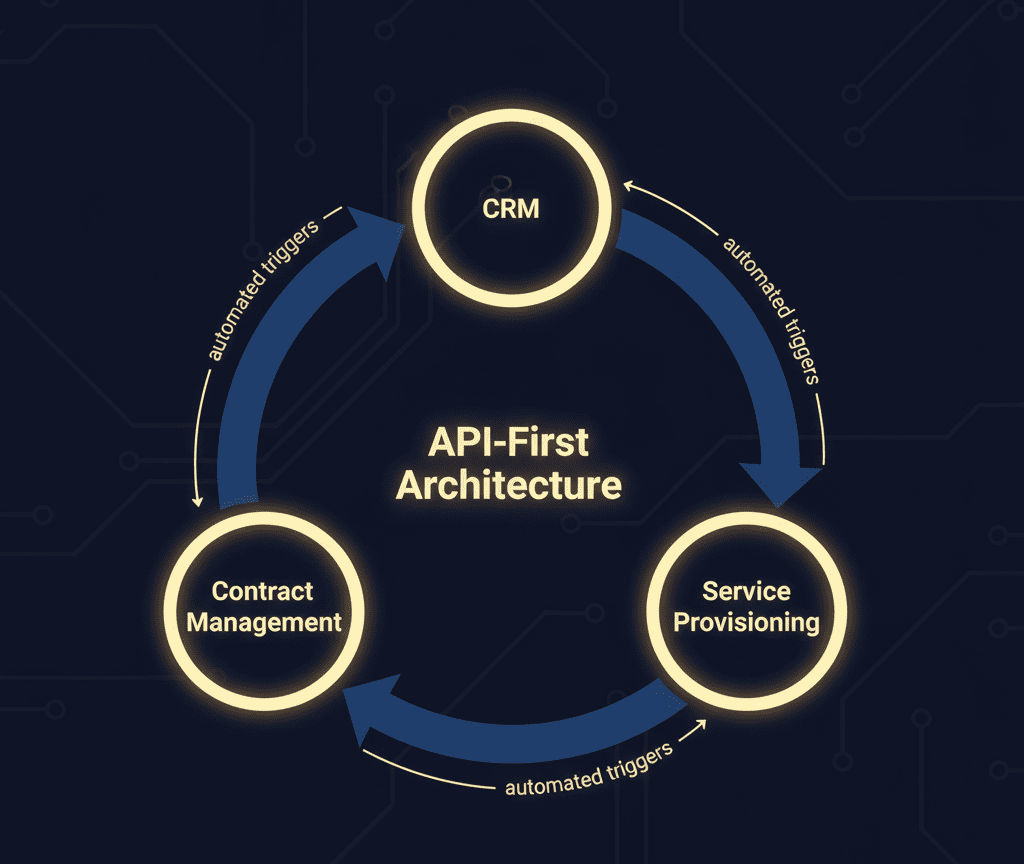

Loop that bypassed cognitive waste. This involved integrating the CRM, contract

management, and service provisioning systems via an API-first architecture. The

system was architected to automatically trigger the next operational node upon the

completion of the preceding one, eliminating the need for manual data validation,

email-based approvals, and other sources of Marginal Cost of Stasis.

III. The Quantifiable Result: Financializing Efficiency

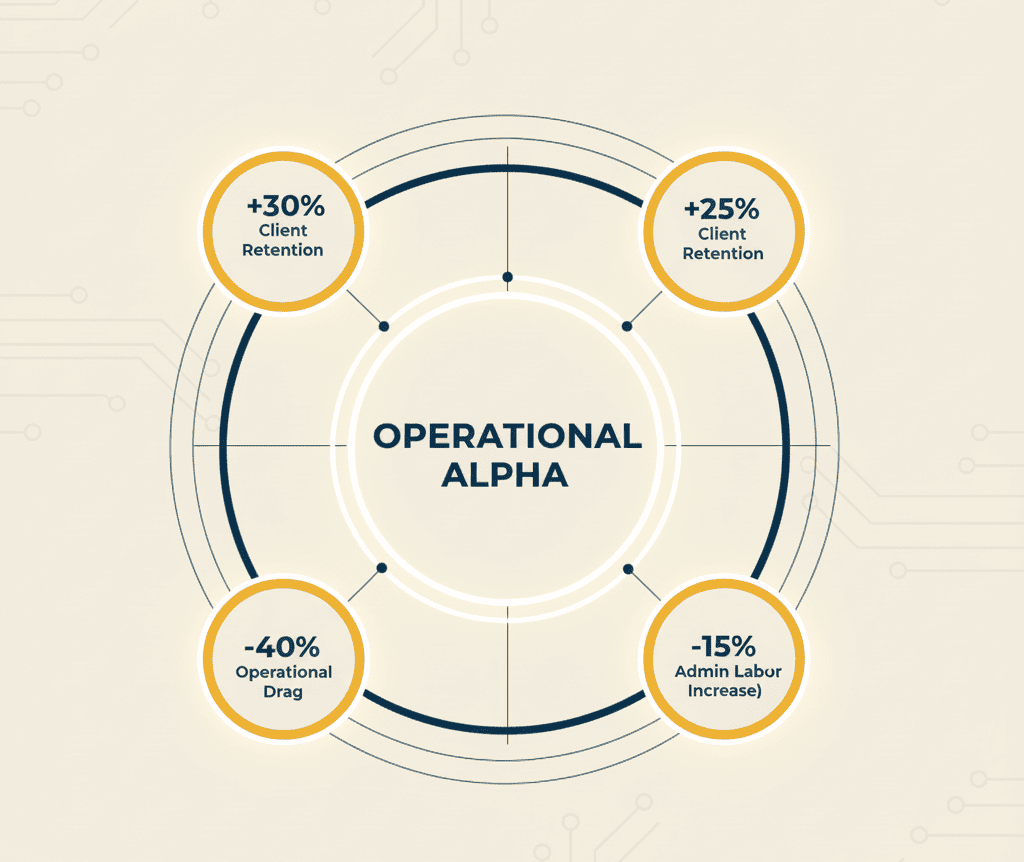

The structural re-architecture yielded immediate and profound financial results. The

firm achieved a 40% reduction in end-to-end operational drag, collapsing the

average contract-to-delivery time from 47 days to a new mean of 28 days. This

systemic velocity translated directly into a 25% increase in annual customer

retention, as the initial client experience was transformed from a friction-laden

process into a seamless, high-velocity onboarding. Furthermore, the elimination of

manual rework and cognitive waste resulted in a 15% decrease in the labor cost of

administrative rework across the Sales and Operations departments. As a secondary,

but critical, metric, the newly liberated capacity allowed the firm to increase its total

service volume by 30% with zero increase in non-revenue generating headcount,

proving that operational efficiency is the most potent form of capital liberation.

IV. Conclusion: Operational Excellence as a Moat

This case study proves that operational excellence is not a secondary cost-reduction

exercise; it is a structural investment that creates an unreplicable financial moat. By

eliminating systemic entropy and architecting for Operational Alpha, the client

transformed its internal processes from a constraint on growth into a competitive

weapon. The resulting velocity and resilience are advantages that competitors, locked

into legacy, friction-laden processes, cannot replicate. The future of enterprise value is

defined by the velocity of its internal flow.