The Architecture of Scalable Business: Engineering Non-Linear Growth and Systemic Resilience

I. The Unacceptable Cost of Linear Growth

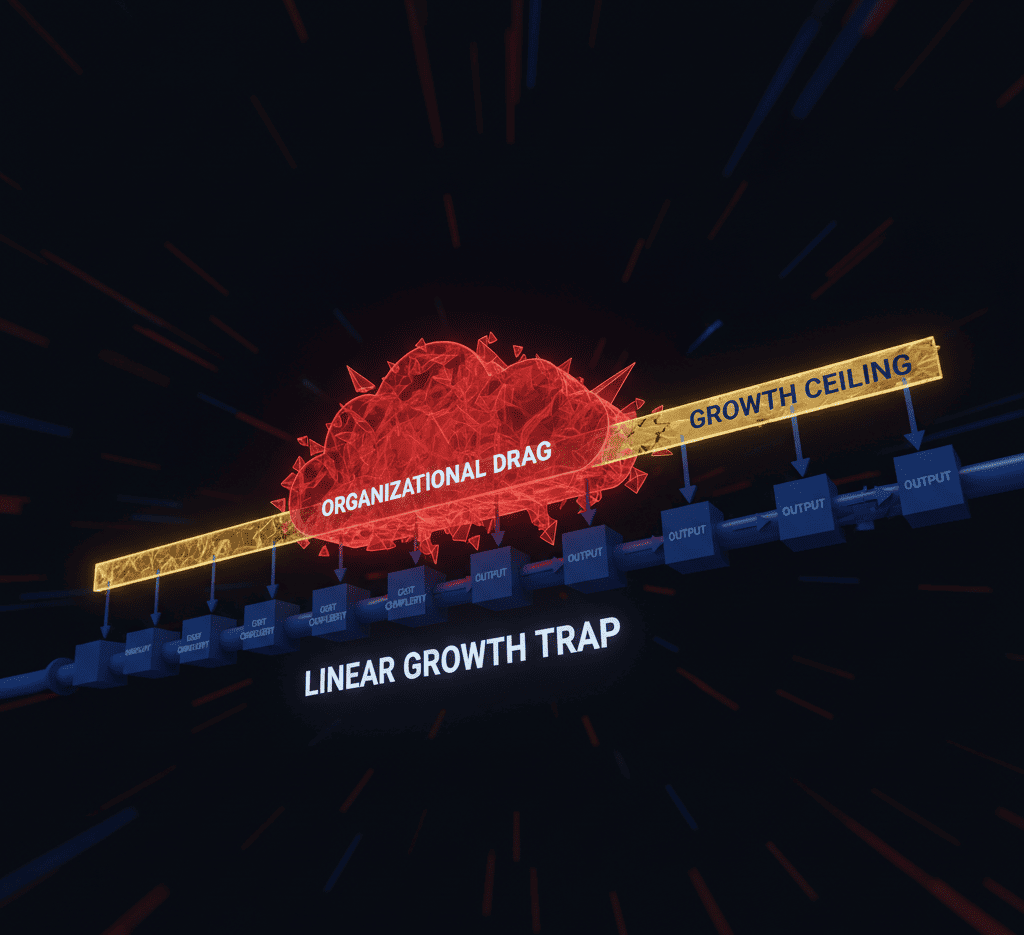

Every business wants to grow, but very few achieve true scale. The difference isn’t luck or timing—it’s architecture. Most companies, even those experiencing explosive revenue growth, eventually slam into a structural ceiling. At this point, every additional dollar of revenue demands a proportional—or worse, disproportionate—increase in operational cost, headcount, and complexity. This is the linear growth trap, and it quietly destroys profitability.

We need to start by clearly defining what we mean by growth versus scale, because these terms are not interchangeable. Growth is additive. It’s the straightforward process of increasing revenue by adding resources: more salespeople, more servers, more office space. Growth follows a 1:1 equation—for every unit of input, you get a predictable unit of output. It’s necessary, but it’s also fragile and expensive.

Scale is fundamentally different. Scale is non-linear. It’s the ability to increase revenue exponentially while costs—technology, process, and labor—grow at a marginal or sub-linear rate. Scaling isn’t about getting bigger; it’s about getting structurally more efficient. You’re engineering a business system where the marginal cost of serving the next customer approaches zero.

When companies fail to transition from linear growth to non-linear scale, it’s rarely because of weak demand or poor strategy. The failure is architectural. The most visible symptom of this architectural flaw is what we call organisational drag—the systemic friction that locks you into linear growth and acts as a constant, invisible tax on productivity.

Organisational drag is the cumulative burden of needless internal interactions: unproductive meetings, redundant communications, bureaucratic handoffs, and endless approval loops. It’s the systemic waste of time, talent, and energy that prevents your organization from operating anywhere near its theoretical maximum. Research shows this drag can consume up to 25% of a company’s productive capacity. It’s the silent killer of margin, and it’s why so many businesses mistake frantic activity for meaningful progress.

The Inefficiency of Redundant Handoffs

The clearest manifestation of organisational drag shows up in redundant handoffs. As companies grow, they tend to bolt new processes onto existing structures rather than redesigning them systematically. The result is convoluted, multi-step workflows where a single piece of information—or a single customer request—has to pass through numerous departments, systems, and individuals before anything gets resolved.

Each handoff introduces friction, delay, and the risk of error. Employees burn cognitive energy constantly context-switching and verifying information that should have transferred seamlessly. This process complexity directly limits throughput, slows decision-making, and inflates your cost-to-serve. For COOs focused on operational excellence, eliminating scaling bottlenecks like these redundant handoffs is a strategic imperative, not a minor efficiency gain.

Systemic Fragility: Why Rapid Growth Leads to Organizational Breakdown

When a structurally flawed business experiences rapid growth, the outcome isn’t triumphant success—it’s systemic fragility. The business isn’t built to absorb increased volume; it’s just being stretched until something breaks.

Think of it like a bridge designed for light traffic suddenly subjected to a constant stream of heavy trucks. Structural flaws—poor system architecture, siloed technology, unclear decision rights—become critical failure points. Under pressure, these weaknesses manifest as:

- Data Inconsistency: Different departments report contradictory metrics, creating strategic paralysis. When Sales, Finance, and Operations can’t agree on basic definitions, leadership is stuck debating data instead of making decisions.

- Process Overload: Manual workarounds that were once manageable become impossible to sustain. Backlogs pile up, customer service collapses, and quality suffers.

- Talent Burnout: Your best people spend their time fighting fires—low-value, reactive work—instead of building systems that prevent fires in the first place.

This breakdown is expensive. It shows up as customer churn, regulatory fines, and the need for costly “rescue” projects that deliver minimal lasting value. A business with systemic fragility can’t scale. It can only grow until it breaks.

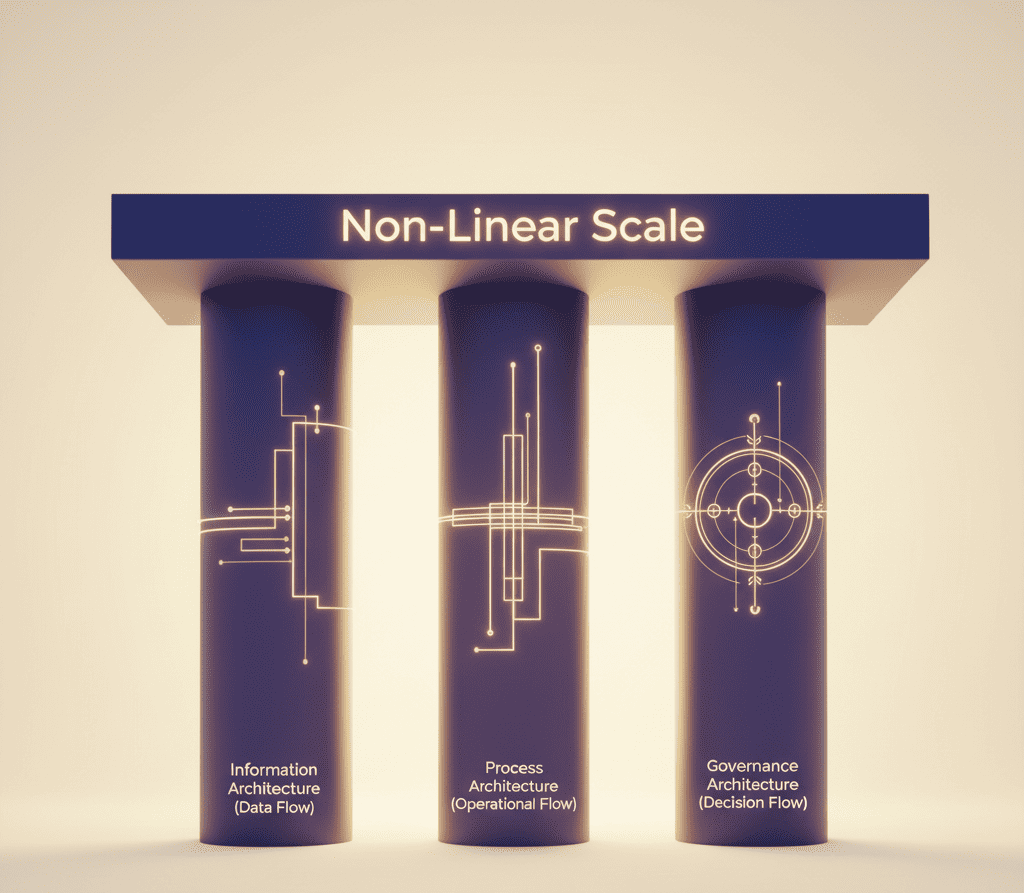

II. The Three Pillars of Business Architecture for Scale

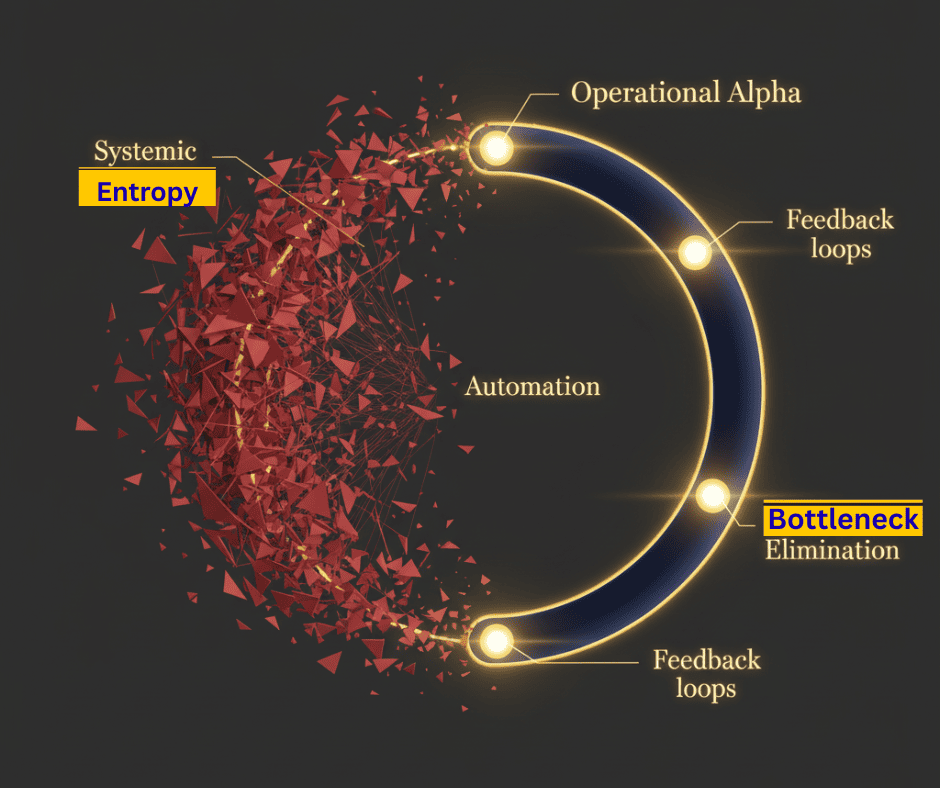

To escape the linear growth trap and engineer a business capable of non-linear scale, you need a systemic, architectural approach. That means designing three essential, integrated systems—what we call the Three Pillars of Business Architecture—that ensure your organisation isn’t just bigger but fundamentally stronger and more efficient. These pillars must be self-optimizing, creating feedback loops that drive continuous improvement and unlock what we call Operational Alpha.

Pillar 1: Information Architecture (Data Flow)

The first pillar is your Information Architecture, which governs how data flows through the organization. In a scalable business, data isn’t a byproduct of operations—it’s the central nervous system that drives every strategic and tactical decision.

The foundational principle here is data integrity: your system must ensure that all strategic decisions are driven by one single source of truth (SSOT). This eliminates what we call data covariance—the dysfunctional state where different parts of the organization operate on contradictory metrics. When Sales, Finance, and Operations each use different numbers to define a “customer,” “profit,” or “qualified lead,” your organization is paralyzed by internal debate instead of focused on external execution.

A well-designed Information Architecture delivers:

- Semantic Consistency: Clear, universal definitions for all key business metrics across every function.

- Real-Time Visibility: Data reaches decision-makers at the speed the business actually operates, not days or weeks later.

- Automated Governance: Systems enforce data quality and consistency, not manual audits or spreadsheet reconciliations.

This pillar transforms data from a historical record into a predictive asset. It enables you to anticipate bottlenecks before they occur and proactively allocate resources where they’ll have the highest impact.

Pillar 2: Process Architecture (Operational Flow)

The second pillar is your Process Architecture, which governs operational flow. This is where the theoretical efficiency of your Information Architecture translates into actual throughput and customer delivery.

The focus here is systemic efficiency—eliminating bottlenecks and building automated, frictionless operational loops. This goes far beyond simple process mapping. You’re designing the entire value chain as a series of integrated, high-velocity pipelines that can absorb increased volume without adding complexity.

Key elements of a scalable Process Architecture include:

- End-to-End Automation: Automating the complete lifecycle of a transaction or service delivery, minimizing human intervention in repetitive, low-value tasks.

- Modular Design: Breaking complex operations into small, independent, easily replaceable modules. This allows for rapid iteration and ensures that a failure in one area doesn’t cascade across the entire system.

- Bottleneck Elimination: Proactively identifying and resolving the single constraint that limits your system’s total output. This is the essence of Operational Alpha—the relentless pursuit of marginal gains in process efficiency that compound over time.

A mature Process Architecture means that as volume increases, your operational system absorbs the load without a corresponding spike in complexity, errors, or manual effort. You achieve true leverage.

Pillar 3: Governance Architecture (Decision Flow)

The third and most overlooked pillar is your Governance Architecture, which dictates decision flow. Even perfectly efficient data and process systems are useless if your organization can’t make decisions quickly.

The focus of Governance Architecture is speed and organizational elasticity—the ability to adapt rapidly without bureaucratic drag. This means designing a decision-making structure that pushes control and authority as close as possible to the data source and the customer interaction.

Traditional hierarchical governance models are inherently slow and become bottlenecks to scale. A scalable Governance Architecture is characterized by:

- Decentralized Authority: Empowering front-line teams to resolve 90% of issues without escalation. This eliminates delay and keeps decision velocity high.

- Clear Decision Rights: Establishing a precise RACI matrix (Responsible, Accountable, Consulted, Informed) for every critical business decision. This eliminates ambiguity and “decision-by-committee” paralysis.

- Feedback Loops: Designing formal mechanisms for continuous learning and improvement, ensuring the other two pillars self-optimize based on real operational data.

By accelerating decision flow, you maintain organizational elasticity—the capacity to rapidly adapt to market changes, competitive threats, and customer demands without grinding to a halt.

III. Conclusion: Designing a Business That Commands a Premium

The ultimate financial imperative for building scalable business architecture is its direct impact on enterprise valuation. A business that has successfully engineered non-linear growth through these three pillars isn’t just operationally superior—it’s a more valuable asset that commands a premium multiple.

Acquirers and investors don’t pay for current revenue alone. They pay for the predictability of future growth with controlled costs. They’re buying structural integrity, not just a customer list. A business with robust architecture offers three critical guarantees:

- Predictable Margins: Your sub-linear cost curve ensures that future revenue growth drops disproportionately to the bottom line, not back into operational expense.

- Reduced Integration Risk: Clear, documented, and automated Information and Process Architectures make your business easier to integrate into a larger entity, reducing deal friction and buyer risk.

- Proven Resilience: Your Governance Architecture demonstrates that the business can absorb increased volume and complexity without organizational breakdown or quality degradation.

In short, a perfectly scalable business is one whose systems are proven to handle future growth with predictable cost control and minimal execution risk. This structural integrity is the single most powerful driver of increased business valuation and the most effective strategy for maximizing shareholder return.

If you’re a CEO preparing for acquisition or a COO responsible for operational performance, the question isn’t whether to invest in business architecture. The question is whether you can afford not to. The difference between growth and scale is the difference between working harder and building smarter—and that difference shows up directly in your valuation multiple.

Ready to engineer non-linear scale in your organization?

Gain immediate access to the complete frameworks, diagnostic tools, and implementation roadmap that transform architectural theory into executable strategy.