Beyond the Logo: The New Rules of Brand Equity — A Fiduciary Approach to Intangible Assets

Brand equity represents the quantifiable financial delta between a commodity product and a preferred asset, measured through premium pricing power, reduced acquisition costs, and enhanced valuation multiples that translate directly into sustainable competitive advantage. This intangible asset, when properly managed, functions as a strategic moat that insulates enterprises from market volatility while simultaneously amplifying growth potential through mechanisms that directly impact the balance sheet and income statement. The contemporary understanding of brand equity has evolved beyond traditional marketing metrics to encompass a sophisticated financial framework that quantifies how brand strength drives enterprise value through multiple pathways: revenue acceleration, margin enhancement, risk reduction, and capital efficiency. Modern brand equity measurement incorporates advanced analytics that connect brand perception metrics to financial performance indicators, enabling executives to manage brand with the same rigor applied to physical assets or working capital optimization.

The Fiduciary Crisis: When Brand Neglect Becomes a Dereliction of Duty

The contemporary boardroom faces a profound crisis of fiduciary responsibility rooted in the systematic underestimation of brand equity as a material financial asset. Creative-first branding—the misguided obsession with colors, fonts, and campaign aesthetics—has deliberately obscured the financial substance of brand as a balance sheet asset, enabling executives to abdicate responsibility for quantifying and managing what constitutes often the most valuable component of enterprise value. This abdication represents not merely strategic malpractice but a fundamental breach of fiduciary duty, as directors and officers fail to account for assets that regularly comprise 30-70% of market capitalization across modern enterprises.

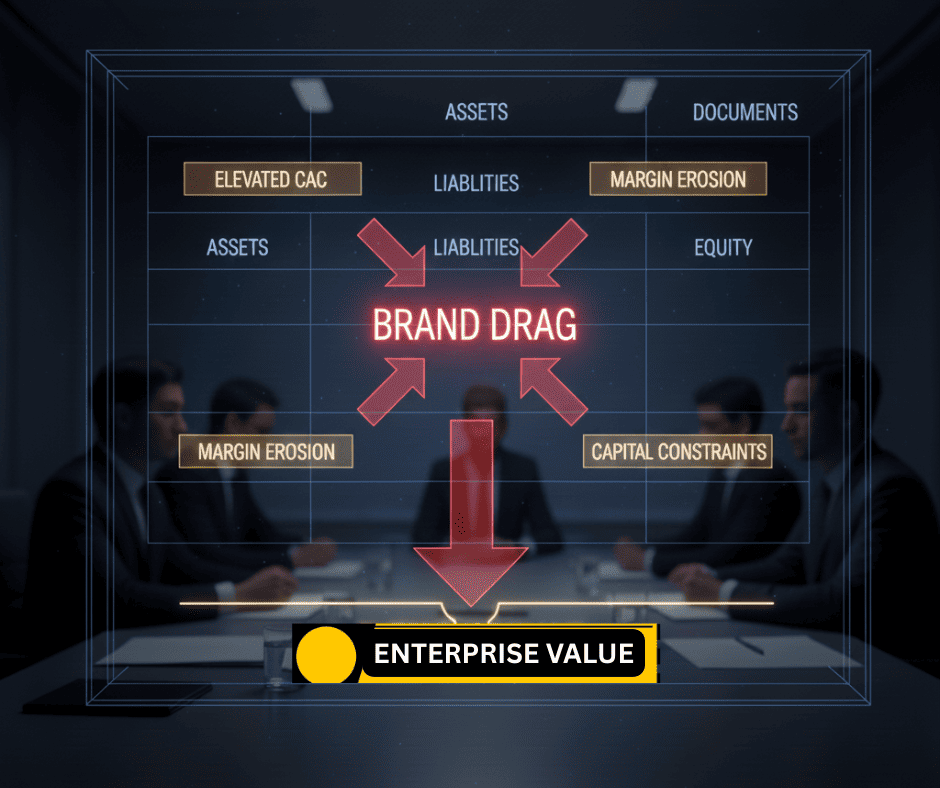

The emergence of Brand Drag—the invisible tax on growth caused by poor perception and inadequate brand quantification—has created a systematic drain on enterprise value that remains largely unmeasured and unmanaged. Brand Drag manifests through multiple financial mechanisms: elevated Customer Acquisition Costs (CAC) that can be 40-60% higher for poorly positioned brands, compressed pricing power that forces margin erosion of 200-400 basis points, and increased capital constraints that limit growth opportunities and raise the cost of capital by 100-300 basis points. Research from BCG demonstrates that companies cutting brand spending experienced total shareholder returns 6 percentage points lower than those maintaining investments, while simultaneously losing 0.8 percentage points of market share—compound effects that destroy billions in enterprise value over typical investment horizons.

The failure to quantify Brand Drag constitutes a material oversight in financial reporting and strategic planning. When brand equity declines due to neglect or mismanagement, the resulting economic impact flows directly through financial statements: revenue growth slows as customers become more price-sensitive, margins compress as promotional dependency increases, and valuation multiples contract as perceived business risk escalates. The absence of brand equity from standard financial models creates a dangerous blind spot where value destruction occurs unnoticed until the cumulative damage becomes irreversible. This represents a systemic failure of corporate governance, as boards and executive teams lack the analytical frameworks necessary to fulfill their oversight responsibilities for what may be the company’s most valuable asset.

Consider the case studies that populate the corporate graveyard: household products manufacturers that shifted spending toward trade promotions and saw initial volume gains followed by accelerating margin erosion and market share loss, or food companies that reduced brand marketing by 40% during downturns, only to require $1.85 of future spending to regain every $1.00 saved. These examples illustrate the profound financial consequences of treating brand as an expense rather than a capital asset—decisions that appear prudent in short-term budget cycles but prove catastrophic over full business cycles. The compounding effect of brand disinvestment creates a value destruction spiral that accelerates over time: reduced brand equity leads to increased price sensitivity, which forces greater promotional spending, which further erodes brand equity—a vicious cycle that can ultimately destroy the franchise value that took decades to build. Modern financial analysis must incorporate brand equity as a critical component of enterprise risk assessment, with dedicated stress testing for brand deterioration scenarios and explicit modeling of brand drag impacts on cash flow projections and valuation multiples.

The Financial Mechanics: Quantifying the Intangible Asset

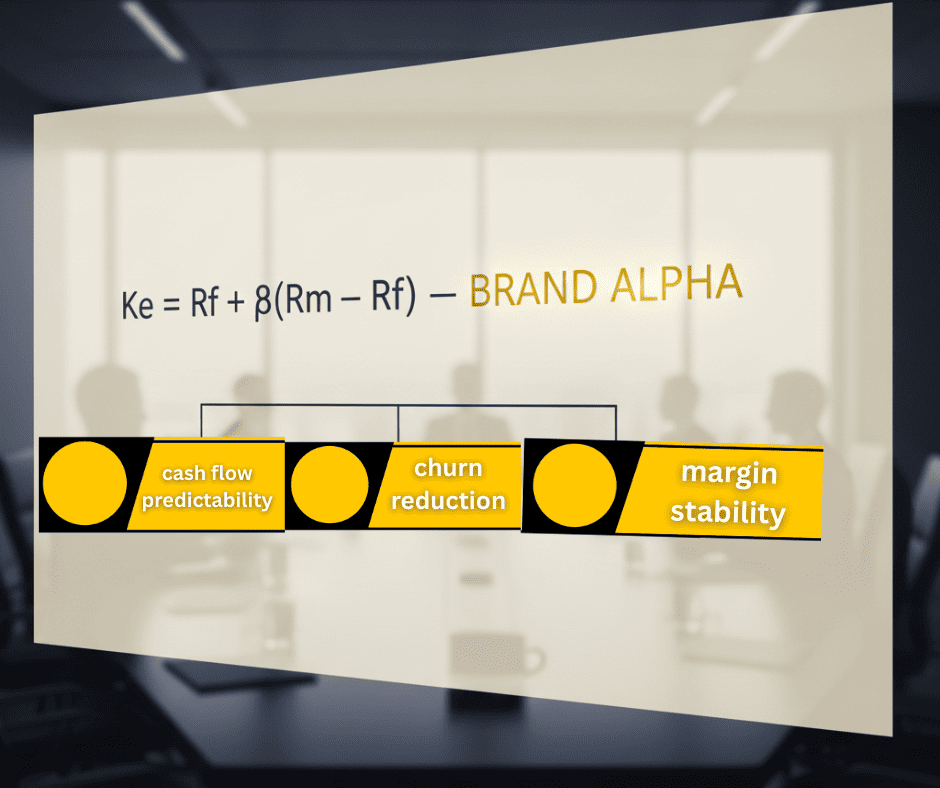

The prevailing failure in modern corporate leadership is the treatment of brand equity as a discretionary marketing expense rather than a high-yield capital asset. In reality, strong brand equity acts as a structural hedge against systemic risk, providing a measurable reduction in the Equity Risk Premium that flows directly into enterprise valuation.

The Brand-Ke Correlation: Lowering the Cost of Capital

The most profound financial impact of brand equity is its ability to lower a firm’s Cost of Equity (Ke). Institutional investors do not value “awareness”; they value the predictability of future cash flows. A dominant brand reduces the volatility of those flows, effectively lowering the return threshold demanded by the market.

This relationship can be expressed through a modified Capital Asset Pricing Model (CAPM), incorporating Brand Alpha:

Ke = Rf + beta(Rm – Rf) – alpha_brand

Where:

Rf: Represents the Risk-Free Rate.

beta(Rm – Rf): Represents the systemic market risk.

alpha_brand (Brand Alpha): Represents the risk-reduction premium generated by structural brand integrity.

For top-tier enterprises, Brand Alpha typically generates a reduction of 100 to 400 basis points in the cost of capital. This is not a theoretical gain; it is a fiduciary reality. By reducing Earnings Volatility, a strong brand minimizes the “uncertainty tax” applied by analysts, ensuring the firm retains a lower discount rate even during periods of high market turbulence.

Margin Defense and the Pricing Power Index (PPI)

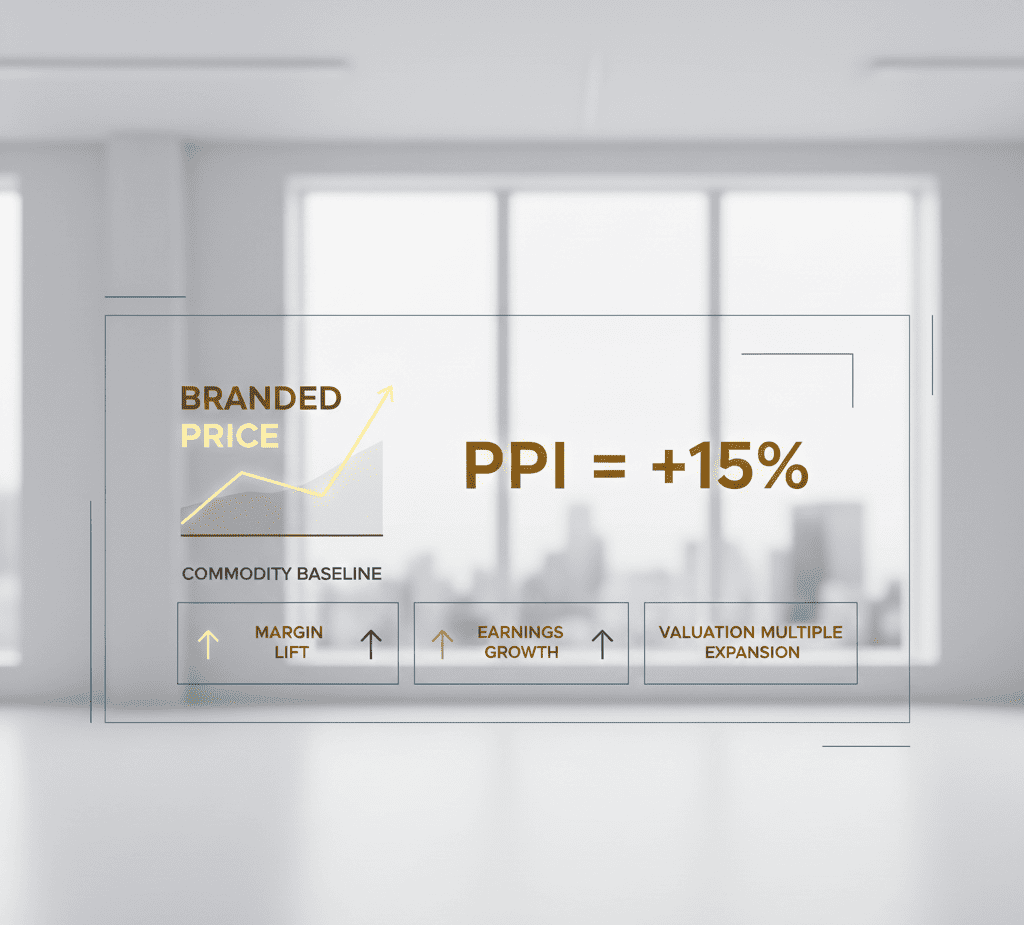

The translation of brand equity into the income statement is best measured through the Pricing Power Index (PPI). In an inflationary or hyper-competitive environment, commodity-based firms are forced into a “race to the bottom” on price. Conversely, brands with high structural integrity demonstrate Price Inelasticity.

Data indicates that premium brands command sustainable price advantages of 5–15% over undifferentiated competitors. This differential is not merely “extra profit”; it is a strategic buffer that protects Gross Margins during supply chain shocks or rising input costs. Loyal customer bases demonstrate a 40-60% lower sensitivity to price increases, effectively de-risking the revenue line.

Operational Leverage: CAC Reduction and CLV Amplification

Beyond the balance sheet, brand equity creates massive Operating Leverage by optimizing the two most critical metrics in growth: Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV).

- CAC Compression: Strong brands benefit from a “Gravity Effect.” Higher organic awareness reduces the reliance on paid performance media, typically yielding a 25-40% CAC advantage over peers.

- CLV Expansion: Brand trust is the primary driver of retention. High-equity brands see 15-25% higher CLV through increased purchase frequency and lower churn.

When CAC is compressed and CLV is expanded simultaneously, the resulting LTV/CAC ratio becomes a non-linear engine for growth, allowing the firm to outspend competitors while maintaining superior profitability.

The Valuation Multiplier: Wealth Creation via Multiple Expansion

The ultimate financial proof of brand equity is found in Valuation Multiples. Strong brands consistently command EV/EBITDA multiples 1.5x to 3.0x higher than their category average.

This “Multiple Expansion” means that for every dollar of earnings, a strong brand creates nearly double the shareholder wealth of a weak one. Investors are not paying for the logo; they are paying for the Resilience Premium—the confidence that the brand will continue to capture market share and defend margins regardless of the economic cycle. For a mid-cap enterprise, this differential represents the gap between a standard exit and a generational wealth-creation event.

The Pricing Power Index: The Ultimate Litmus Test of Brand Equity

The Pricing Power Index (PPI) serves as the definitive metric for quantifying brand equity’s financial impact, measuring the differential between a brand’s realized pricing and the commodity pricing floor in its category. PPI is calculated through a straightforward formula:

PPI = Branded price – Commodity price \ commodity price * 100

In plain English: take the price your brand actually commands in the market, subtract what a generic or unbranded competitor would charge for the same product, then divide that difference by the generic price and multiply by 100 to express it as a percentage.

For example, if your premium coffee sells for $12 per pound while generic coffee commands $8 per pound, your PPI would be calculated as: (($12 – $8) ÷ $8) × 100 = 50%. This means your brand equity enables you to charge 50% more than the commodity alternative.

Where P_brand represents the average realized price for your branded product and P_commodity represents the price of functionally equivalent unbranded alternatives. This metric provides a direct, unambiguous measure of brand value in financial terms, transcending subjective measures of awareness or preference to focus on the ultimate economic outcome: premium pricing that customers willingly pay.

Strong PPI performance correlates directly with financial resilience and value creation. Companies maintaining PPI above 10% typically demonstrate gross margins 300-500 basis points higher than category averages, earnings growth rates 200-400 basis points above competitors, and enterprise value multiples 1.5-2.5x greater than undifferentiated peers. The Margin of Safety provided by brand loyalty—measured through PPI sustainability during economic stress—represents one of the most valuable risk mitigation attributes available to modern enterprises, effectively insulating cash flows from competitive and cyclical pressures that commoditize weaker brands.

PPI dynamics reveal critical insights about brand health and competitive positioning. Declining PPI typically precedes revenue erosion by 12-18 months, providing an early warning system for brand deterioration that allows proactive intervention before financial performance suffers. Similarly, PPI expansion often signals successful brand strengthening initiatives, with improvements in brand equity typically requiring 9-18 months to manifest in measurable pricing advantages. The time lag between brand investment and PPI response underscores the importance of patient, consistent investment in brand building rather than reactive, short-term tactics.

The relationship between PPI and Customer Acquisition Cost creates a virtuous cycle that compounds financial returns. Strong PPI reduces price sensitivity, enabling more efficient marketing investments and higher conversion rates across customer acquisition channels. This efficiency improvement reduces CAC by 20-40%, which in turn allows greater reinvestment in brand building, further strengthening PPI over time. Companies that successfully optimize this PPI-CAC flywheel typically achieve marketing ROI 50-80% higher than competitors and generate sustainable competitive advantages that are difficult for rivals to replicate.

Industry analysis reveals significant PPI variation across categories, with personal care and luxury goods typically achieving PPI of 25-50%, food and beverage ranging 10-25%, and household products averaging 5-15%. These differences reflect varying levels of emotional connection, functional differentiation, and consumer involvement across categories. However, within each category, PPI leaders consistently outperform laggards on every financial metric, confirming PPI’s universal relevance as a measure of brand equity financial impact. The PPI framework enables sophisticated competitive analysis, allowing companies to benchmark their pricing power against category leaders and identify specific opportunities for brand strengthening initiatives.

Structural Brand Integrity: Operationalizing the Brand Promise

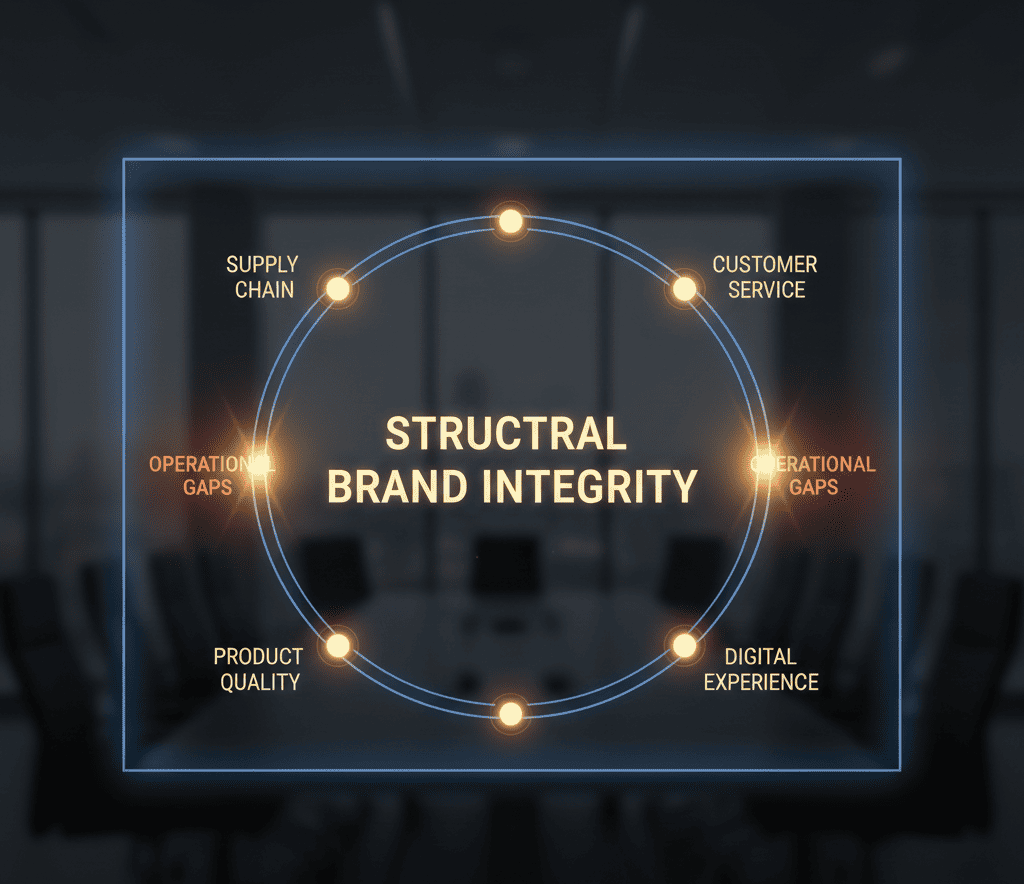

Structural Brand Integrity (SBI) represents the critical convergence between brand promise and operational delivery—the systemic alignment of all organizational capabilities to consistently deliver the value proposition that brand equity promises. SBI transcends traditional brand management by recognizing that brand equity cannot be sustained through communication alone; it requires the systematic integration of brand principles into every operational system, process, and decision. When SBI is achieved, the brand becomes not merely a marketing construct but an operational reality that customers experience consistently across all touchpoints.

The absence of SBI creates Operational Friction—the gap between brand promise and customer experience that systematically destroys brand equity regardless of marketing investment levels. Operational Friction manifests through multiple failure points: product quality inconsistencies, customer service variability, supply chain unreliability, and digital experience fragmentation. Each friction point represents a brand equity liability that compounds over time, with research showing that negative experiences are 3-5x more impactful than positive ones in brand perception formation. Organizations failing to achieve SBI experience brand equity erosion rates 40-60% higher than competitors.

Operational Alpha—the unique, unreplicable edge that drives outsized returns—can only be achieved when SBI provides the foundation for differentiated customer experiences. Elevion’s research demonstrates that companies with high SBI scores typically achieve operating margins 200-400 basis points above industry averages, customer retention rates 15-25% higher than competitors, and employee engagement scores 20-30% above category benchmarks. These performance differentials stem from the compounding effect of consistent delivery across all customer touchpoints, creating a self-reinforcing cycle of trust, loyalty, and advocacy that becomes increasingly difficult for competitors to disrupt.

Achieving SBI requires fundamental organizational transformation that transcends traditional marketing boundaries. True SBI demands that brand principles inform supply chain design, technology architecture, human resources practices, and financial decision-making—creating a holistic system where every operational element serves the brand promise. This integration requires new measurement frameworks that track operational performance against brand standards, governance structures that ensure brand consistency across functions, and incentive systems that reward cross-functional collaboration in brand delivery.

The financial impact of SBI extends beyond traditional brand metrics to fundamental business performance improvements. Companies with high SBI typically experience supply chain costs 5-10% lower due to reduced returns and rework, customer service costs 15-25% lower through reduced complaint volume, and innovation success rates 30-40% higher through stronger brand-customer relationships. When operational systems deliver what the brand promises, brand equity becomes sustainable rather than situational—creating compounding advantages that amplify over time and generate increasing returns to scale. The implementation of SBI requires sophisticated measurement systems that track operational performance against brand standards across all functional areas. Advanced SBI frameworks incorporate real-time customer experience monitoring, predictive analytics for identifying potential brand delivery failures, and closed-loop systems that rapidly address operational gaps before they impact brand perception. Leading organizations are increasingly investing in digital twin technologies that simulate the customer experience across all touchpoints, enabling proactive identification and resolution of operational friction before it impacts brand equity. The convergence of operational excellence and brand promise delivery represents the next frontier in competitive advantage, as companies recognize that sustainable brand equity cannot be achieved through marketing alone but requires the systematic integration of brand principles into every operational system and process.

Conclusion: The Boardroom Mandate for Capitalizing Brand Equity

The fundamental shift from “Brand as Expense” to “Brand as Capital” represents one of the most significant opportunities for value creation in modern corporate governance, requiring boards and executive teams to apply the same rigor to brand management as to physical asset optimization. This transformation demands new frameworks for brand valuation, new metrics for performance assessment, and new governance structures for oversight—evolving brand from a marketing responsibility to an enterprise-wide strategic imperative. Companies that successfully make this transition typically achieve enterprise value 20-40% higher than competitors over 5-year horizons, demonstrating the substantial wealth creation potential of proper brand equity management.

The Valuation Multiplier Effect of strong brand equity creates exponential value creation through multiple amplification mechanisms: margin enhancement through pricing power, growth acceleration through customer loyalty, risk reduction through cash flow stability, and multiple expansion through investor confidence. When these effects compound over time, the cumulative impact can increase enterprise value by 2-3x relative to undifferentiated competitors. This multiplier effect explains why brand-focused acquirers consistently pay premium multiples for strong brands and why private equity firms increasingly prioritize brand strength as a key investment criterion.

For boards and executives, the mandate is clear: brand equity must be treated with the same analytical rigor and strategic importance as any other critical business asset. This requires implementing comprehensive brand valuation methodologies, establishing governance structures for brand oversight, creating measurement systems that connect brand equity to financial performance, and developing talent capabilities that bridge marketing and finance disciplines. The companies that master this transition will not only create superior shareholder returns but will also build more resilient, sustainable enterprises capable of thriving across market cycles and competitive disruptions. The transformation demands new organizational structures that break down traditional silos between marketing, finance, operations, and technology functions. Modern brand governance requires cross-functional leadership teams with shared accountability for brand equity development, sophisticated analytics capabilities that measure brand impact across all business dimensions, and investment frameworks that optimize the balance between short-term performance and long-term brand building. Boards must evolve their oversight capabilities to include brand expertise, establishing dedicated brand committees or expanding existing audit committees to encompass brand risk assessment and valuation monitoring. The most successful companies will treat brand equity as a core strategic asset that informs mergers and acquisitions decisions, capital allocation priorities, talent development programs, and technology investment strategies—creating a holistic approach to brand management that drives sustainable competitive advantage and superior financial performance.

The journey from brand ignorance to brand mastery represents one of the most significant opportunities for value creation available to modern corporations. By applying financial discipline to brand management, implementing rigorous measurement frameworks, and building operational systems that deliver brand promises, enterprises can unlock the full potential of their most valuable intangible asset. The question is no longer whether brand equity matters, but whether corporate leaders have the courage and capability to capitalize it effectively in service of sustainable value creation.

While this strategic analysis provides the foundation for understanding brand equity’s financial mechanics, the tactical implementation requires proprietary methodologies and advanced analytical frameworks. The Brand Equity Valuation Manual extends this strategic foundation to provide comprehensive tools for calculating the Brand Drag Coefficient (BDC)—a metric that quantifies the invisible tax poor brand perception places on growth—implementing Pricing Power Index measurements that track your premium pricing capabilities, and developing Structural Brand Integrity assessment frameworks that evaluate how well your operations deliver your brand promises.

These operational capabilities enable organizations to move from theoretical understanding to practical value creation, transforming brand equity from an abstract concept into a measurable, manageable asset that drives sustainable financial performance. The manual provides step-by-step methodologies for conducting brand equity audits, calculating the financial impact of brand investments, and developing governance structures that treat brand equity with the same rigor applied to other balance sheet assets.