Case Study: From Noise to Signal

I. The Challenge: Commodity Death in a Saturated Market

A B2B SaaS company specializing in workflow automation for mid-market professional services was rapidly scaling, achieving $23 million in revenue and serving 520 enterprise customers. Yet, despite 31% year-over-year growth, the organization was trapped in a crisis of complete commoditization. They operated in a crowded market with over 40 functionally equivalent competitors.

The client was caught in a strategic no-man’s-land: possessing neither the brand dominance of established category leaders nor the clear pricing advantage of new disruptors. Their sales cycles ballooned to an average of 127 days because prospects treated the purchasing process as pure procurement—a feature-by-feature checklist where vendors were interchangeable.

Strategic Invisibility: Competitive analysis confirmed their vulnerability. The client’s messaging, visual identity, and go-to-market narrative were essentially generic. In blind messaging tests, prospects could correctly identify the client’s unique value proposition only 23% of the time, a result statistically indistinguishable from random chance.

This strategic invisibility had severe financial consequences:

Pricing Power Erosion: They could only command a 4% average premium over rivals, and 67% of all closed deals required discounts exceeding 15% just to seal the sale.

CAC Inflation: Customer Acquisition Cost (CAC) surged 43% over 18 months, as the effort required to justify an undifferentiated product increased exponentially.

Competitive Churn: Annual churn sat at 19%, with 72% of lost accounts switching to a competitor, confirming that customers viewed the platforms as interchangeable alternatives.

The client recognized revenue growth masked a downward cycle: undifferentiated positioning forced pricing concessions, which eroded margins, in turn limiting product investment—a cycle that required fundamental structural repositioning.

II. The Elevion Intervention: Architecting Distinction

Elevion’s diagnostic determined the root cause: the client was competing on the terms of the market incumbents, accepting a commoditized category definition that guaranteed perpetual feature-parity competition. The solution was to reject the existing category taxonomy entirely and architect a Unique Market Position—redefining the problem space to establish the client as the singular solution.

Phase 1: Category Redefinition through Cognitive Capture

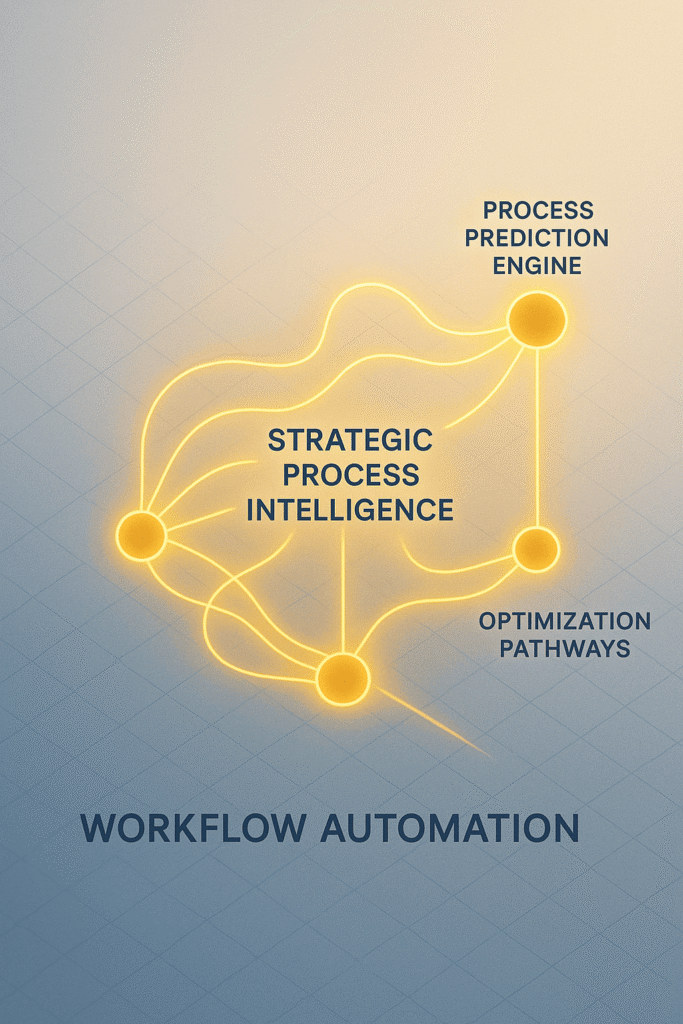

We shifted the battleground from “workflow automation” (an oversaturated category) to “Strategic Process Intelligence.” We found customers needed more than just automated speed; they needed systems that surfaced strategic patterns, predicted bottlenecks, and offered optimization pathways.

This insight became the foundation for Cognitive Capture—owning not just a market position, but the conceptual framework prospects use for evaluation. The client became “the Strategic Process Intelligence system,” shifting the evaluation criteria from a feature checklist to a diagnosis of a newly articulated market need.

Phase 2: Brand Architecture Reconstruction

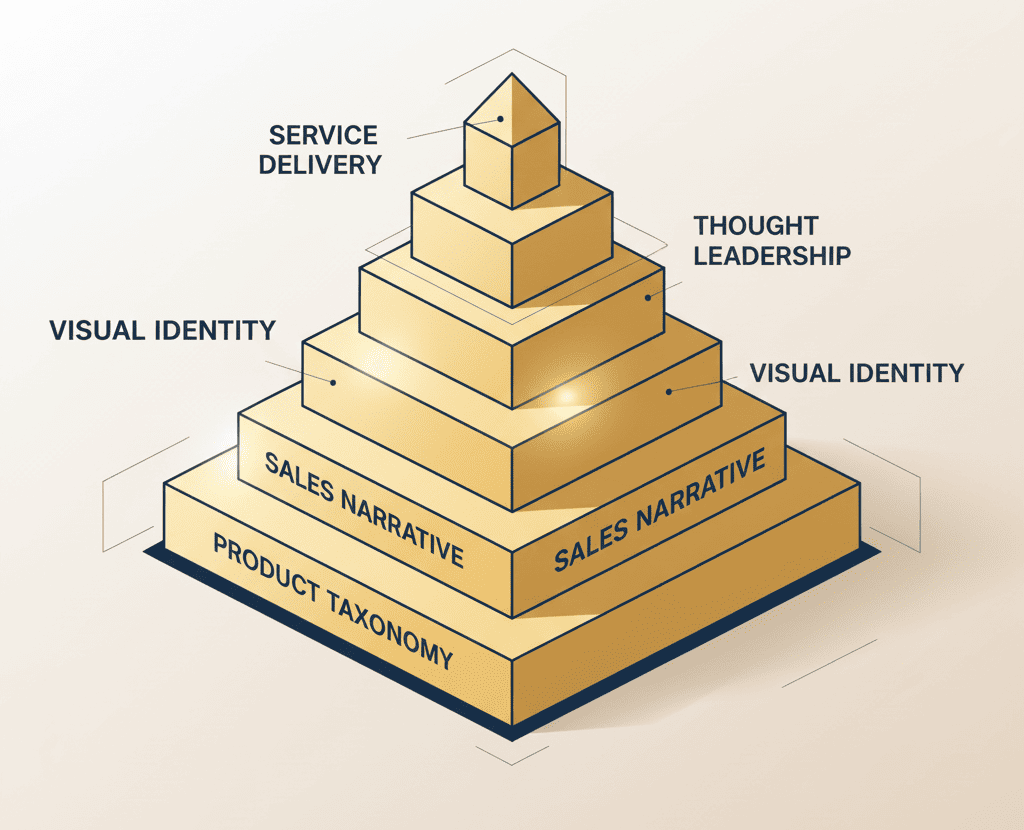

The new position demanded comprehensive structural fidelity across five operational layers:

Product Taxonomy: Feature-parity language was eliminated. Proprietary nomenclature was introduced, such as “Process Prediction Engine” and “Bottleneck Intelligence,” technically aligning the product roadmap with the new promise of strategic insights.

- Sales Narrative: The sales process shifted from product demonstration to Strategic Consultation. Sales teams were trained on the “Strategic Process Intelligence Framework,” repositioning them as category experts rather than vendors.

- Visual Identity & Semantics: The brand commissioned a redesign to eliminate generic aesthetic clichés. Proprietary terms (e.g., “Process Intelligence Quotient,” “Strategic Automation Maturity Model”) were developed, creating linguistic ownership in the new category.

- Thought Leadership: Content shifted from feature education to category-building. Definitive research was published (e.g., “The Process Intelligence Gap”), educating the market about the new problem and positioning the client as the authoritative source.

- Service Delivery: Customer success dashboards were restructured to emphasize strategic outcomes—optimization recommendations and predictive accuracy—ensuring the customer experience validated the differentiated positioning.

This deep operational alignment established a true competitive moat because differentiation was embedded in the organization’s DNA, making replication impossible through mere marketing adjustments.

III. The Quantifiable Result: Building the Moat

The intervention generated immediate and sustainable financial alpha, confirming that structural clarity is the ultimate competitive advantage.

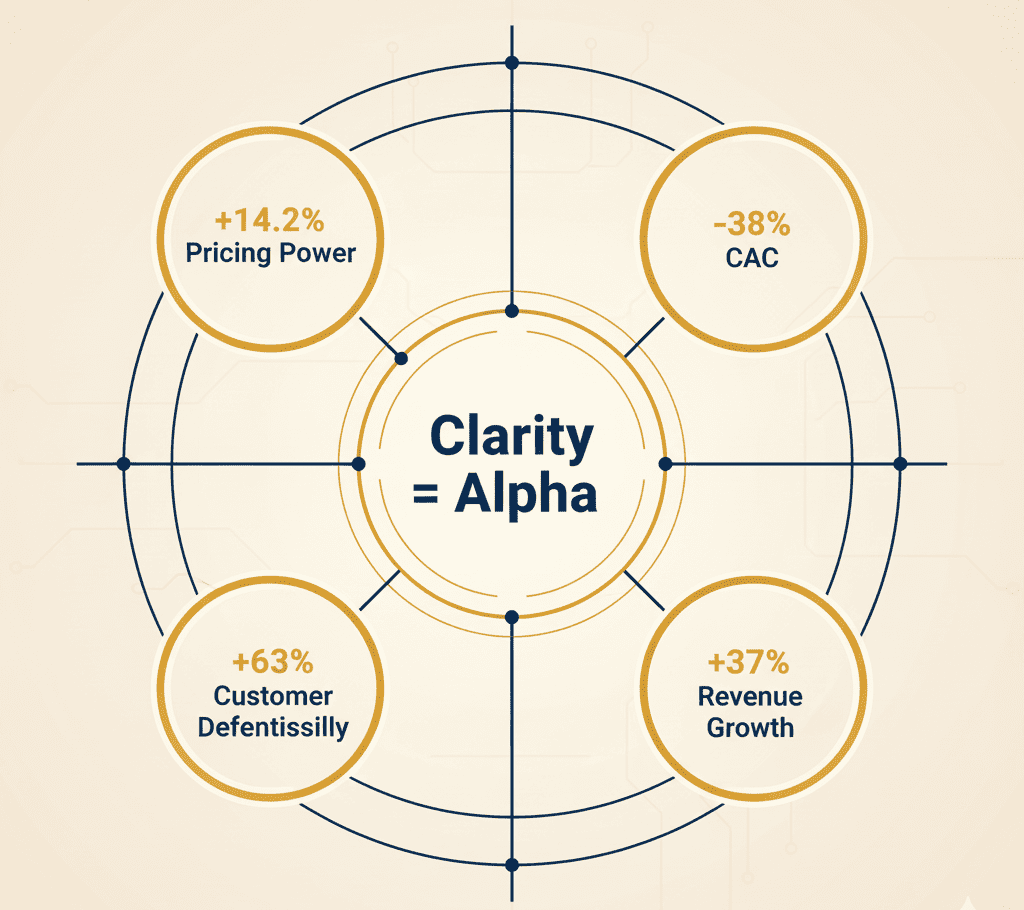

Primary Outcome: 14.2% Pricing Power Premium

- Within 11 months, the client achieved a 14.2% average pricing premium over competitors.

- Annual Contract Value (ACV) rose from $44,300 to $50,600—generating $3.28 million in annualized incremental revenue on the existing customer base alone.

- The frequency of discounting dropped from 67% to 31% of all deals, and the average discount depth was nearly halved. The sales cycle compressed by 30% (from 127 to 89 days) as clear distinction eliminated competitive evaluation paralysis.

Secondary Outcome: 38% Customer Acquisition Cost Reduction

- CAC decreased from $16,800 to $10,400 per customer—a 38% efficiency improvement, saving $3.33 million annually in marketing spend.

- The Category of One positioning catalyzed inbound demand: Organic search traffic increased 127% on proprietary terminology, and qualified lead generation dramatically improved from thought leadership assets.

Tertiary Outcome: Competitive Moat—63% Improvement in Customer Defensibility

- Competitive displacement churn decreased by 63% (from 13.7% to 5.1% of accounts).

- Average customer tenure is now projected to increase from 3.2 years to 5.4 years. The Strategic Process Intelligence framework created high operational switching costs: customers had internalized the client’s proprietary language and methodology, making migration to a generic competitor a massive organizational barrier.

IV. Conclusion: The Value of Clarity

The client’s journey validates that commoditization is a strategic failure, not an inevitable market reality. By replacing superficial marketing with structural brand clarity, Elevion enabled the client to reject the commodity framework, redefine the market, and establish a position that competitors could not easily imitate and customers could not easily abandon. The premium pricing and cost efficiency are the direct, quantifiable result of trading mere narrative for architectural distinction.