The Economics of Emotion: The Financial Case for a Resonant Brand

Role: Chief Financial Strategist and Valuation Expert, Elevion .

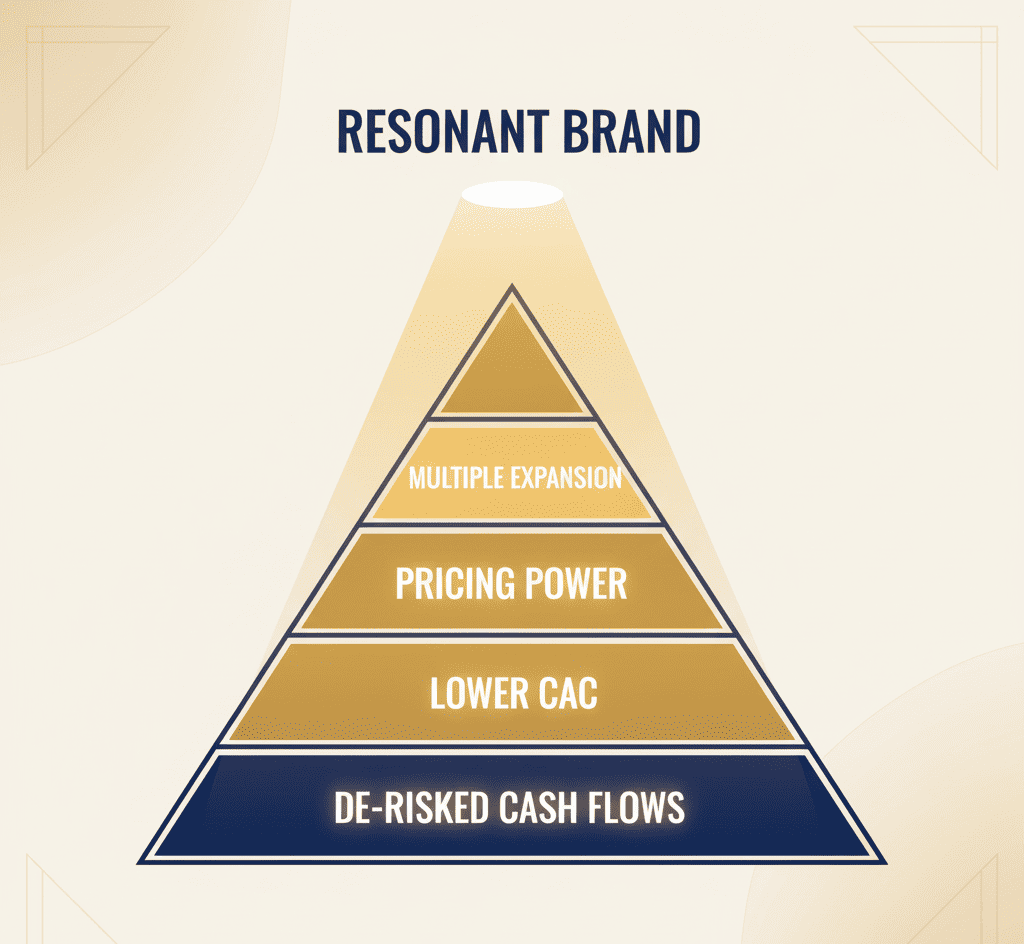

The modern C-suite must discard the antiquated notion that brand building is a discretionary marketing expense. In a market where intangible assets drive over 80% of enterprise value, the brand is not a cost center; it is the single most powerful, measurable, and de-risked financial asset a company possesses. This is the financial case for a resonant brand, argued not in the language of sentiment, but in the irrefutable metrics of the balance sheet, the P&L, and enterprise valuation.

I. Intangibles are the New Assets

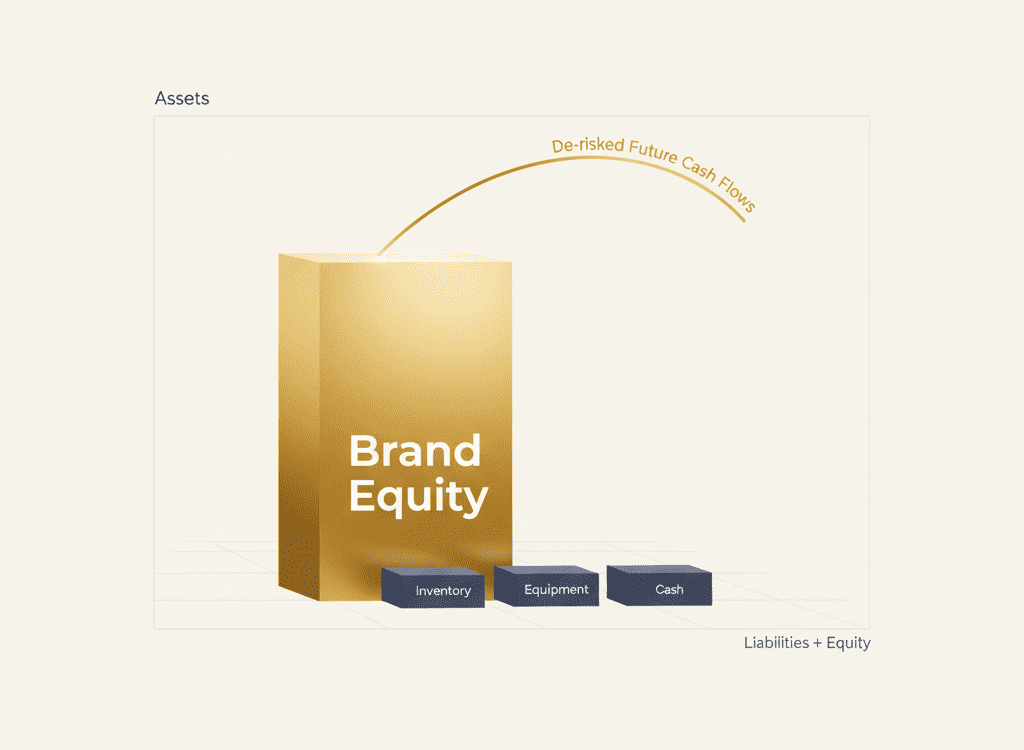

The core thesis is that brand is the single largest intangible asset, a structural moat that dictates the predictability and magnitude of future cash flows. Traditional accounting, with its reliance on historical cost, fundamentally fails to capture this reality. The balance sheet, in its current form, is a misleading document that obscures the true drivers of value.

We define brand equity not in the soft currency of consumer feelings, but in the hard currency of de-risked future cash flows. A resonant brand achieves cognitive capture—it owns a proprietary conceptual framework in the mind of the executive buyer, thereby creating structural switching costs. This is the mechanism by which an emotional connection is translated into a financial barrier to entry for competitors.

The value of a strong brand is the present value of the economic rents it generates. These rents manifest as superior pricing power and lower customer acquisition costs, which are the direct inputs into any rigorous valuation model. Ignoring this asset is not merely a strategic oversight; it is a fiduciary failure that undervalues the enterprise and exposes it to unnecessary market volatility.

II. The Brand Dividend: Quantifying the WACC Effect

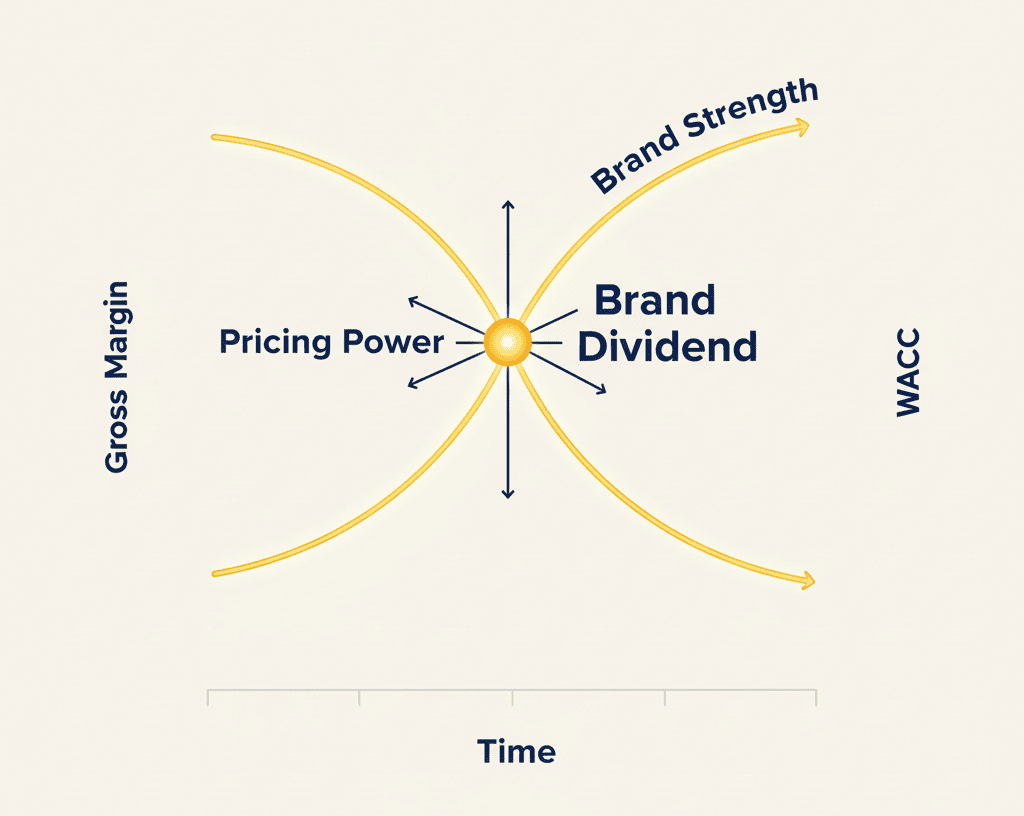

A structurally architected brand delivers a quantifiable Brand Dividend that improves operating leverage and fundamentally alters the risk profile of the firm. This dividend is realized through three primary financial mechanisms:

1. Increases Pricing Power (Improving Gross Margin)

A resonant brand moves the product from a price-sensitive commodity to a value-justified solution. This structural differentiation allows the firm to command a pricing premium over competitors, which flows directly to the gross margin.

| Brand Strength | Pricing Power | Gross Margin Impact | Financial Terminology |

| Commodity | Price-taker (0-5% premium) | Exposed to cost volatility | Low Economic Rent |

| Resonant Brand | Price-maker (15%+ premium) | Structural margin expansion | High Economic Rent |

This structural margin expansion is the most immediate and visible financial return on brand investment. It provides the capital necessary for sustained R&D and market expansion, creating a self-reinforcing financial flywheel.

2. Lowers Customer Acquisition Cost (Improving Operating Leverage)

A strong brand is a powerful filter and a pre-qualifier. It reduces the friction in the sales cycle by attracting customers who are already intellectually aligned with the value proposition. This translates directly into a lower Customer Acquisition Cost (CAC). The brand does the heavy lifting of differentiation, allowing the sales and marketing functions to operate with superior efficiency. This improvement in operating leverage is a critical signal to investors, demonstrating the firm’s ability to scale profitably.

Reduces the Risk Premium, Lowering the Weighted Average Cost of Capital (WACC)

This is the most profound financial impact. Enterprise valuation is fundamentally a function of discounted future cash flows, and the discount rate is the Weighted Average Cost of Capital (WACC). A resonant brand acts as a powerful de-risking agent, reducing both the cost of equity and the cost of debt.

- Cost of Equity: A predictable, defensible revenue stream (secured by brand-driven switching costs) lowers the perceived volatility of the firm’s earnings. This reduces the Beta in the Capital Asset Pricing Model (CAPM), which in turn lowers the cost of equity.

- Cost of Debt: A strong brand signals stability and market leadership to creditors, improving credit ratings and lowering the cost of debt financing.

The net effect is a lower WACC. A lower WACC means that the firm’s future cash flows are discounted at a lower rate, resulting in a higher present enterprise valuation. The brand is not just increasing the numerator (cash flows); it is aggressively shrinking the denominator (WACC).

III. Brand as Balance Sheet Defense

The defensive value of a resonant brand is its capacity to act as a hedge against external shock. In times of recession, competitive entry, or supply chain failure, the brand provides a critical layer of insulation that protects the balance sheet.

A strong brand translates directly into a superior LTV/CAC ratio. By increasing Lifetime Value (LTV) through reduced churn and higher pricing, and simultaneously lowering CAC, the firm’s unit economics become structurally superior to its commoditized rivals.

Furthermore, a resonant brand reduces customer elasticity during price changes. Customers of a structurally defined brand are less likely to defect when prices increase because the perceived value is non-substitutable. This allows the firm to maintain profitability and market share during inflationary periods or when competitive pressures intensify. The brand is the structural defense that guarantees revenue predictability.

IV. The Valuation Imperative

The financial community has moved beyond superficial metrics. Private Equity (PE), Venture Capital (VC), and M&A specialists are now prioritizing companies with architected brand moats because they signal predictable, defensible future profitability.

In the M&A context, the premium paid for a target company is often a direct function of its intangible assets, with brand being the most significant. A structurally sound brand reduces the due diligence risk and justifies a higher multiple because the revenue stream is perceived as more secure and less exposed to competitive erosion.

The valuation imperative is clear: the brand is the ultimate financial lever. It is the mechanism by which a firm transforms tactical market success into structural, long-term enterprise value. Those who continue to treat brand as a subjective marketing cost will find their firms structurally undervalued and exposed to the aggressive forces of commoditization. Those who architect their brand as a financial asset will secure a dominant, defensible position in the market.