Beyond Simple Analytics: The Elevion Predictive Engine

The Crisis of Retrospective Data

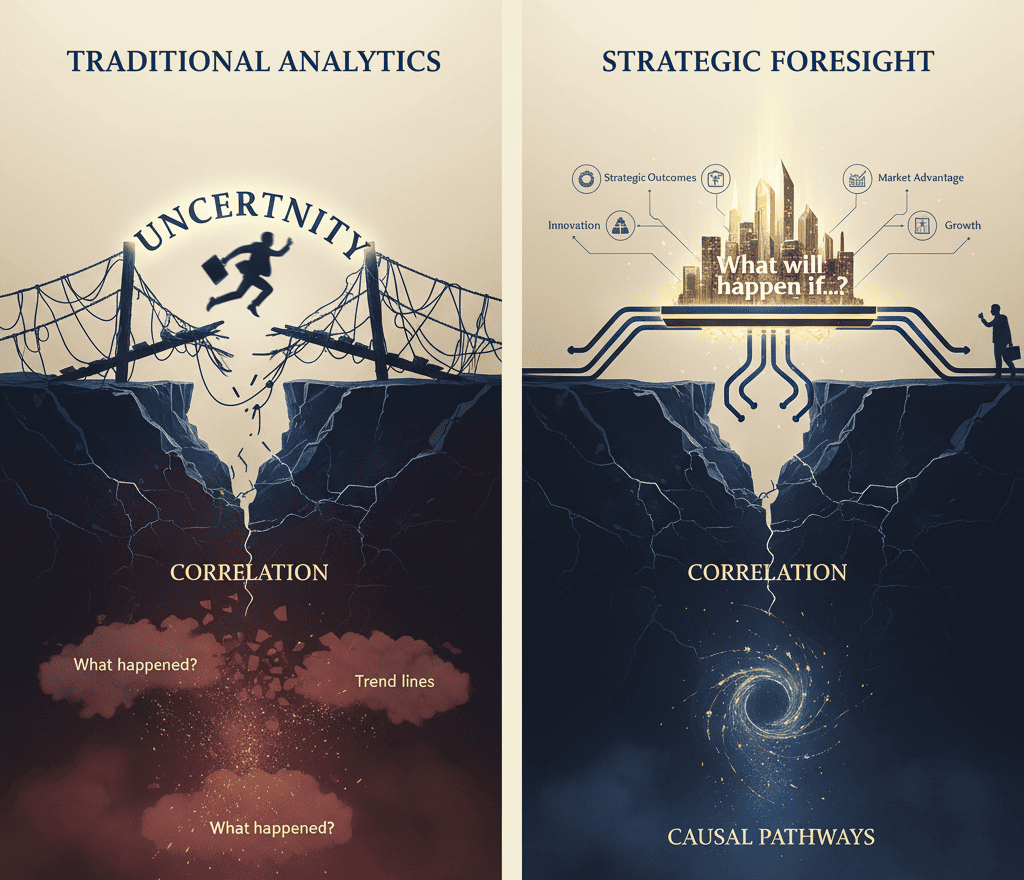

The contemporary business intelligence paradigm suffers from a fundamental epistemological deficiency that renders it structurally incapable of generating predictive advantage: an exclusive reliance on retrospective correlation analysis as the basis for forward-looking strategic decisions. Traditional analytics infrastructure—regardless of computational sophistication or data volume—operates by identifying patterns in historical outcomes and extrapolating those patterns into probabilistic forecasts. This methodology implicitly assumes that future market dynamics will replicate historical structures, that relationships observed in past data reflect stable causal mechanisms, and that strategic environments evolve through continuous, linear trajectories rather than discontinuous regime changes.

These assumptions are demonstrably false in contemporary market conditions characterized by technological disruption, regulatory discontinuities, and consumer behavior shifts that occur at velocities exceeding organizational adaptation capacity. Yet the “Big Data” revolution of the past decade has paradoxically intensified rather than remedied this vulnerability by providing organizations with unprecedented volumes of retrospective information while offering no methodological advancement in causal understanding. The result is strategic planning architectures that operate with increasing confidence on fundamentally compromised epistemological foundations—more data creates the illusion of certainty while the underlying analytical framework remains incapable of distinguishing genuine causal relationships from spurious correlations that will dissolve under changed conditions.

The pathology manifests most acutely in the phenomenon of strategic lag—the temporal gap between market inflection points and organizational recognition of those shifts. Traditional analytics can only detect trends after sufficient data accumulation demonstrates pattern deviation from baseline, guaranteeing that strategic responses occur after competitive advantage windows have partially or fully closed. This lag is not a processing speed problem addressable through computational improvements; it is an inherent limitation of retrospective correlation analysis that cannot be remedied within the existing analytical paradigm. When a market experiences non-linear disruption—regulatory change, technological breakthrough, macroeconomic shock, or consumer preference discontinuity—historical correlations become actively misleading rather than merely uninformative, causing organizations to allocate capital toward strategies optimized for conditions that no longer exist.

The crisis deepens when organizations recognize correlational insights as insufficient for causal decision-making but lack methodological alternatives. The standard response is to supplement quantitative analysis with qualitative expert judgment, effectively acknowledging that data-driven insights require human interpretation to identify causal mechanisms. This hybrid approach fails because it reintroduces the cognitive biases, confirmation tendencies, and bounded rationality that quantitative methods were intended to eliminate. The organization oscillates between trusting retrospective correlations that may lack causal validity and relying on executive intuition that may reflect psychological heuristics rather than market reality. Neither approach provides the causal certainty required for high-stakes strategic decisions involving irreversible capital allocation, market positioning, or organizational architecture investments.

The Epistemological Shift to Causal Inference

Elevion’s Predictive Engine represents a categorical departure from retrospective analytics through the operationalization of causal inference methodologies developed at the intersection of machine learning, econometrics, and computational statistics. Rather than identifying correlational patterns in historical data and projecting them forward, our infrastructure constructs explicit causal models that represent the mechanistic relationships between strategic actions and business outcomes. This epistemological shift relocates the analytical question from “What happened?” and “What correlates with success?” to the fundamentally more actionable inquiry: “What will happen if we execute strategic intervention X under market condition Y?”

The technical implementation centers on directed acyclic graphs (DAGs) and structural causal models that encode the dependency relationships between variables in the business system. These models distinguish between variables that merely correlate due to common causes versus those that possess genuine causal relationships where intervention on one variable produces predictable changes in another. The construction process integrates multiple data sources—longitudinal business metrics, experimental intervention results, domain expertise encoded as structural constraints, and external market signals—to identify causal pathways while controlling for confounding variables that contaminate traditional correlational analysis.

The critical innovation lies in counterfactual reasoning capability: the ability to answer questions about outcomes that would occur under conditions not present in historical data. Traditional analytics can describe what happened when specific actions were taken; causal inference can predict what would have happened had different actions been chosen, enabling rigorous comparison of strategic alternatives without the cost and risk of real-world experimentation. This capability eliminates the fundamental limitation of retrospective analysis—the inability to evaluate paths not taken or strategies not yet attempted.

Operationally, this causal infrastructure manifests through Synthetic Market Environments (SMEs)—computational simulations that model the business ecosystem including customer behavior, competitive responses, regulatory constraints, and macroeconomic conditions. Unlike traditional scenario planning that relies on qualitative narrative construction, SMEs execute quantitative simulations grounded in causal models validated against historical data and continuously updated with real-time market signals. Each simulation run represents a complete counterfactual trajectory: a probabilistic future that would unfold given specific strategic choices and market conditions.

The SME architecture enables systematic stress-testing of strategic assumptions across thousands of probabilistic scenarios simultaneously. Rather than planning for a single “most likely” future or a handful of qualitative scenarios, organizations can evaluate strategic robustness across the full distribution of plausible futures, identifying strategies that generate asymmetric returns—options with bounded downside risk but substantial upside potential under favorable conditions. This analytical capacity reveals strategic opportunities invisible to traditional methods: market entry timing windows, capital allocation optima, organizational capability sequences, and competitive positioning choices that possess favorable risk-return profiles across diverse future scenarios.

Critically, the causal models identify leverage points—variables where strategic intervention produces disproportionate impact on desired outcomes. Traditional analytics treats all correlations as potentially informative; causal inference reveals which variables are mechanistically connected to strategic objectives versus those that merely correlate due to confounding relationships. This distinction determines capital allocation efficiency: investment flows toward initiatives with demonstrated causal efficacy rather than dissipating across activities that correlate with success without driving it.

The methodology also addresses the temporal dimension of strategic planning through dynamic causal modeling that accounts for feedback loops, time-varying relationships, and path dependencies. Real-world business systems exhibit complex dynamics where today’s decisions alter tomorrow’s opportunity set, where competitive responses reshape market structures, and where organizational capabilities compound or decay based on investment sequences. Static causal models that ignore these dynamics produce misleading predictions; Elevion’s temporal causal framework models these interdependencies explicitly, revealing optimal strategic sequences and timing sensitivities that maximize cumulative returns across multi-period horizons.

The Epistemological Shift to Causal Inference

Elevion’s Predictive Engine represents a categorical departure from retrospective analytics through the operationalization of causal inference methodologies developed at the intersection of machine learning, econometrics, and computational statistics. Rather than identifying correlational patterns in historical data and projecting them forward, our infrastructure constructs explicit causal models that represent the mechanistic relationships between strategic actions and business outcomes. This epistemological shift relocates the analytical question from “What happened?” and “What correlates with success?” to the fundamentally more actionable inquiry: “What will happen if we execute strategic intervention X under market condition Y?”

The technical implementation centers on directed acyclic graphs (DAGs) and structural causal models that encode the dependency relationships between variables in the business system. These models distinguish between variables that merely correlate due to common causes versus those that possess genuine causal relationships where intervention on one variable produces predictable changes in another. The construction process integrates multiple data sources—longitudinal business metrics, experimental intervention results, domain expertise encoded as structural constraints, and external market signals—to identify causal pathways while controlling for confounding variables that contaminate traditional correlational analysis.

The critical innovation lies in counterfactual reasoning capability: the ability to answer questions about outcomes that would occur under conditions not present in historical data. Traditional analytics can describe what happened when specific actions were taken; causal inference can predict what would have happened had different actions been chosen, enabling rigorous comparison of strategic alternatives without the cost and risk of real-world experimentation. This capability eliminates the fundamental limitation of retrospective analysis—the inability to evaluate paths not taken or strategies not yet attempted.

Operationally, this causal infrastructure manifests through Synthetic Market Environments (SMEs)—computational simulations that model the business ecosystem including customer behavior, competitive responses, regulatory constraints, and macroeconomic conditions. Unlike traditional scenario planning that relies on qualitative narrative construction, SMEs execute quantitative simulations grounded in causal models validated against historical data and continuously updated with real-time market signals. Each simulation run represents a complete counterfactual trajectory: a probabilistic future that would unfold given specific strategic choices and market conditions.

The SME architecture enables systematic stress-testing of strategic assumptions across thousands of probabilistic scenarios simultaneously. Rather than planning for a single “most likely” future or a handful of qualitative scenarios, organizations can evaluate strategic robustness across the full distribution of plausible futures, identifying strategies that generate asymmetric returns—options with bounded downside risk but substantial upside potential under favorable conditions. This analytical capacity reveals strategic opportunities invisible to traditional methods: market entry timing windows, capital allocation optima, organizational capability sequences, and competitive positioning choices that possess favorable risk-return profiles across diverse future scenarios.

Critically, the causal models identify leverage points—variables where strategic intervention produces disproportionate impact on desired outcomes. Traditional analytics treats all correlations as potentially informative; causal inference reveals which variables are mechanistically connected to strategic objectives versus those that merely correlate due to confounding relationships. This distinction determines capital allocation efficiency: investment flows toward initiatives with demonstrated causal efficacy rather than dissipating across activities that correlate with success without driving it.

The methodology also addresses the temporal dimension of strategic planning through dynamic causal modeling that accounts for feedback loops, time-varying relationships, and path dependencies. Real-world business systems exhibit complex dynamics where today’s decisions alter tomorrow’s opportunity set, where competitive responses reshape market structures, and where organizational capabilities compound or decay based on investment sequences. Static causal models that ignore these dynamics produce misleading predictions; Elevion’s temporal causal framework models these interdependencies explicitly, revealing optimal strategic sequences and timing sensitivities that maximize cumulative returns across multi-period horizons.

The Engine’s Output: Autonomous Foresight

The Predictive Engine generates outputs qualitatively distinct from traditional business intelligence deliverables: not retrospective reports describing market conditions, not correlational dashboards highlighting historical patterns, but Autonomous Foresight—continuously updated, causally validated strategic blueprints that specify optimal actions under current and anticipated market conditions. This represents a fundamental transformation in the relationship between analytical infrastructure and strategic decision-making.

Traditional analytics functions as a retrospective documentation system: analysts produce reports that executives interpret to form strategic judgments. The analytical output is informational—it describes what happened—but the causal reasoning and strategic synthesis occur within human cognitive processes subject to bias, bounded rationality, and inconsistent application. Autonomous Foresight inverts this architecture: the causal reasoning occurs within the algorithmic infrastructure, producing decision-ready strategic specifications that require human judgment only for values alignment and risk tolerance calibration rather than causal interpretation.

The output manifests as de-risked strategic blueprints that specify not merely what to do, but the causal pathway by which actions generate desired outcomes, the conditions under which strategies succeed or fail, the leading indicators that signal when assumptions are violated, and the contingency protocols triggered by scenario deviations. This level of specification enables confident execution by eliminating the ambiguity that plagues traditional strategic planning: executives understand not just the recommended strategy but the mechanistic reasoning underlying it and the empirical signals that would invalidate it.

The “autonomous” designation reflects the infrastructure’s capacity for continuous operation independent of human initiation. Rather than producing quarterly strategy updates following scheduled analytical cycles, the Predictive Engine maintains persistent surveillance of market conditions, competitive dynamics, and internal performance metrics. When causal models detect condition changes that alter strategic optima—regulatory shifts, competitive actions, demand pattern evolution, operational performance deviations—the system automatically recalibrates strategic blueprints and alerts decision-makers to required adjustments. This eliminates the temporal lag inherent in periodic planning cycles where strategies optimized for past conditions persist despite changed circumstances.

Critically, Autonomous Foresight functions as the architectural foundation for all other Elevion capabilities, creating systemic integration that compounds strategic advantage. Brand Fortification strategies are causally optimized to create switching costs and pricing power based on predictive models of customer behavior and competitive positioning. Market Entry timing and positioning decisions exploit informational asymmetries identified through predictive scanning for emerging demand and competitive blind spots. Operational Alpha initiatives prioritize systematization of activities with demonstrated causal impact on strategic outcomes rather than optimizing visible inefficiencies. Digital Marketing Execution allocates budget and messaging based on predictive resonance modeling rather than retrospective channel performance.

This integration eliminates the coordination failures and strategic incoherence that emerge when discrete capabilities operate on independent information architectures. Every organizational function executes strategies derived from a unified causal understanding of market dynamics, competitive positioning, and strategic objectives. The result is execution coherence that compounds returns: marketing reinforces brand moat, operations enable market entry velocity, brand architecture supports pricing power that funds capability development. The system exhibits positive feedback loops where each capability’s success improves others’ performance through shared causal intelligence.

IV. Engage the Source of Alpha

The contemporary strategic environment presents organizations with an unambiguous epistemological choice: continue operating on intuition-driven planning architectures that mistake correlation for causation and retrospective patterns for predictive insight, or transition to causal inference infrastructures that replace strategic speculation with algorithmic certainty. This is not a question of incremental analytical improvement—it represents a categorical shift in decision-making foundations equivalent to the transition from qualitative business judgment to quantitative analytics that defined management science in the late twentieth century.

The competitive dynamics of this transition are unforgiving. Organizations that implement causal forecasting infrastructure gain compounding temporal advantages over those operating on retrospective analytics: they identify opportunities before competitors, position preemptively for market shifts, and allocate capital with superior risk-return profiles. These advantages accumulate rather than diminish—early movers establish market positions that become self-reinforcing through network effects, brand equity, and operational sophistication that latecomers cannot rapidly replicate. The window for establishing predictive advantage narrows as methodologies diffuse and competitive intensity increases in asymmetric opportunity spaces.

The strategic imperative is existential rather than aspirational. Markets characterized by accelerating change velocity, decreasing competitive response times, and increasing capital efficiency requirements systematically select for organizations with superior predictive capability. Intuition-driven strategy—regardless of executive quality or historical track record—cannot compete against algorithmic foresight that operates on causal models updated in real-time with market signals. The question facing organizational leaders is not whether to adopt predictive infrastructure, but whether adoption occurs proactively while strategic advantages remain available, or reactively after competitive displacement reveals the inadequacy of retrospective analytics.