Case Study: Unlocking 18% Margin Growth

I. The Challenge: Margin Erosion and Operational Guesswork

Client Profile:

A high-growth direct-to-consumer consumer electronics brand generating $47 million in annual revenue experienced catastrophic margin compression despite achieving 22% year-over-year top-line growth. Over an 18-month period, gross margins deteriorated from 41% to 28%—a 13-percentage-point erosion representing $6.3 million in annualized profit destruction. The compression accelerated rather than stabilized, with the steepest decline occurring in the final quarter before engagement, signaling systematic rather than cyclical failure.

The Failure Point:

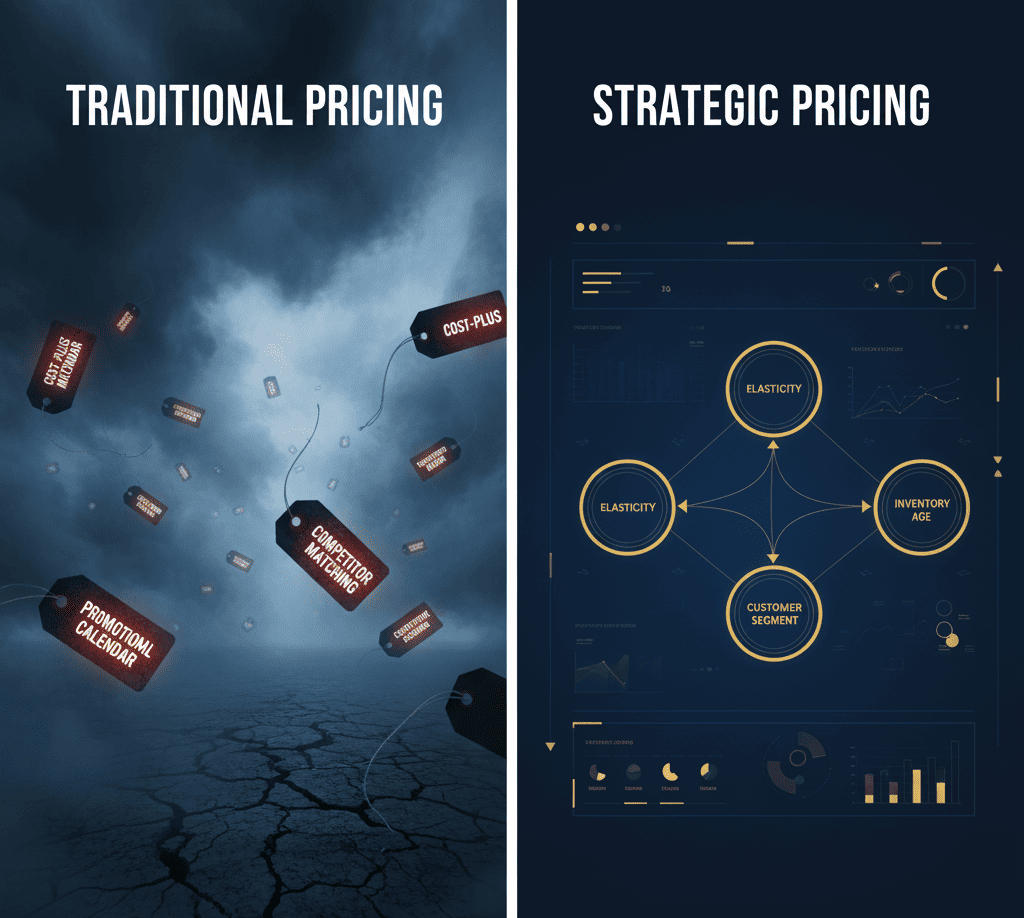

The client operated on a fundamentally compromised pricing architecture combining three dysfunctional methodologies: cost-plus pricing with fixed margin targets (ignoring demand elasticity), reactive competitor price matching (following irrational benchmarks without causal validation), and calendar-driven promotional timing (based on historical seasonality rather than real-time demand signals). This retrospective decision-making infrastructure generated three catastrophic failure modes that directly caused the margin erosion.

First, the cost-plus model maintained standard pricing during 14 identifiable demand spike events where customers demonstrated significantly higher willingness-to-pay, forgoing $2.1 million in capturable margin. Second, the competitor matching protocol triggered 47 price reductions over 18 months, with causal analysis revealing that 31 of these matched irrational competitor actions (inventory clearance, loss leaders, pricing errors), transferring $1.8 million in unnecessary margin to customers. Third, the fixed promotional calendar systematically over-discounted during strong demand periods while under-discounting during weak demand periods, creating $2.4 million in combined margin waste through unnecessary promotional destruction and aged inventory accumulation requiring emergency clearance.

The organization recognized the margin compression but lacked the analytical infrastructure to distinguish causal drivers from correlational noise. Internal consensus-based pricing decisions oscillated between aggressive discounting (destroying margin unnecessarily) and rigid premium positioning (accumulating aged inventory). The team optimized for volume metrics—units sold, revenue growth, market share proxies—while unit economics deteriorated invisibly beneath top-line expansion. Traditional business intelligence dashboards described the margin erosion but provided no mechanistic explanation or corrective pathway, leaving leadership paralyzed between contradictory strategic hypotheses with no empirical validation methodology.

II. The Elevion Intervention: Algorithmic Pricing Architecture

The Solution:

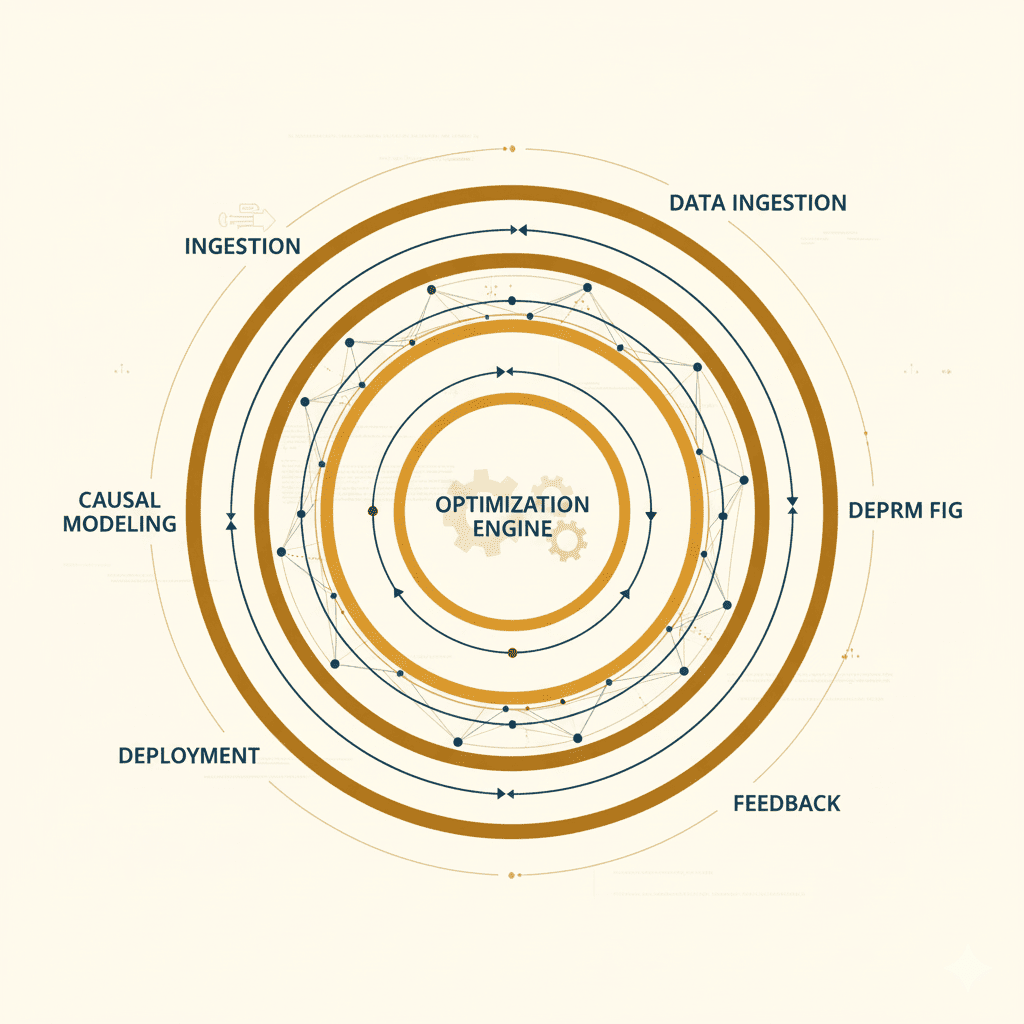

Elevion deployed a closed-loop Autonomous Pricing System integrating the Predictive Engine’s causal inference capabilities with Operational Alpha’s execution infrastructure. The system replaced retrospective correlation analysis with real-time demand elasticity modeling, enabling the organization to transition from asking “What prices did we charge?” to the fundamentally more actionable question: “What prices should we charge given causal demand mechanisms, competitive dynamics, and inventory positions?”

The technical architecture constructed granular causal models of price-demand relationships across product categories, customer segments, temporal contexts, and competitive conditions. Using instrumental variable regression to eliminate endogeneity bias, the system estimated demand elasticity ranging from 0.6 (loyal customers on flagship products) to 2.8 (promotional acquisition customers on commodity categories). Counterfactual simulation via synthetic control methodology enabled evaluation of pricing scenarios without historical precedent, projecting demand responses under hypothetical price points through weighted combinations of comparable historical periods.

The Process:

The Autonomous Pricing Loop operated through five integrated layers executing continuous optimization cycles every six hours. The input layer ingested real-time data streams including transaction-level sales, inventory positions by SKU and age, competitive pricing across 230 comparable products, search trend data, social sentiment signals, and customer behavioral indicators. The causal inference engine processed these inputs to update demand elasticity models, cross-elasticity relationships, and temporal dynamics including customer acquisition economics and competitive response patterns.

The optimization engine formulated pricing decisions as a constrained maximization problem balancing four weighted objectives: short-term margin maximization (40%), long-term customer lifetime value optimization (35%), inventory risk minimization (15%), and strategic market share protection (10%). The system solved for optimal prices across 180 active SKUs simultaneously, accounting for portfolio effects and subject to brand positioning constraints (maintain 7% premium on flagship products), inventory turnover targets (95% of units <60 days aged), and margin floor protections.

Optimized prices deployed automatically to e-commerce platforms via API integration while synchronizing marketing spend allocation (increasing budget on high-margin SKUs, reducing spend on promotional items) and inventory management protocols (triggering replenishment on fast-moving high-margin products, initiating markdown sequences on aged inventory). Human oversight operated through executive-defined strategic guardrails, ethical compliance protocols, real-time performance monitoring with automatic circuit breakers, and A/B testing frameworks validating new strategies on subset traffic before full deployment.

III. The Quantifiable Result: Strategic Alpha Delivered

Primary Outcome: 18.3% Gross Margin Expansion

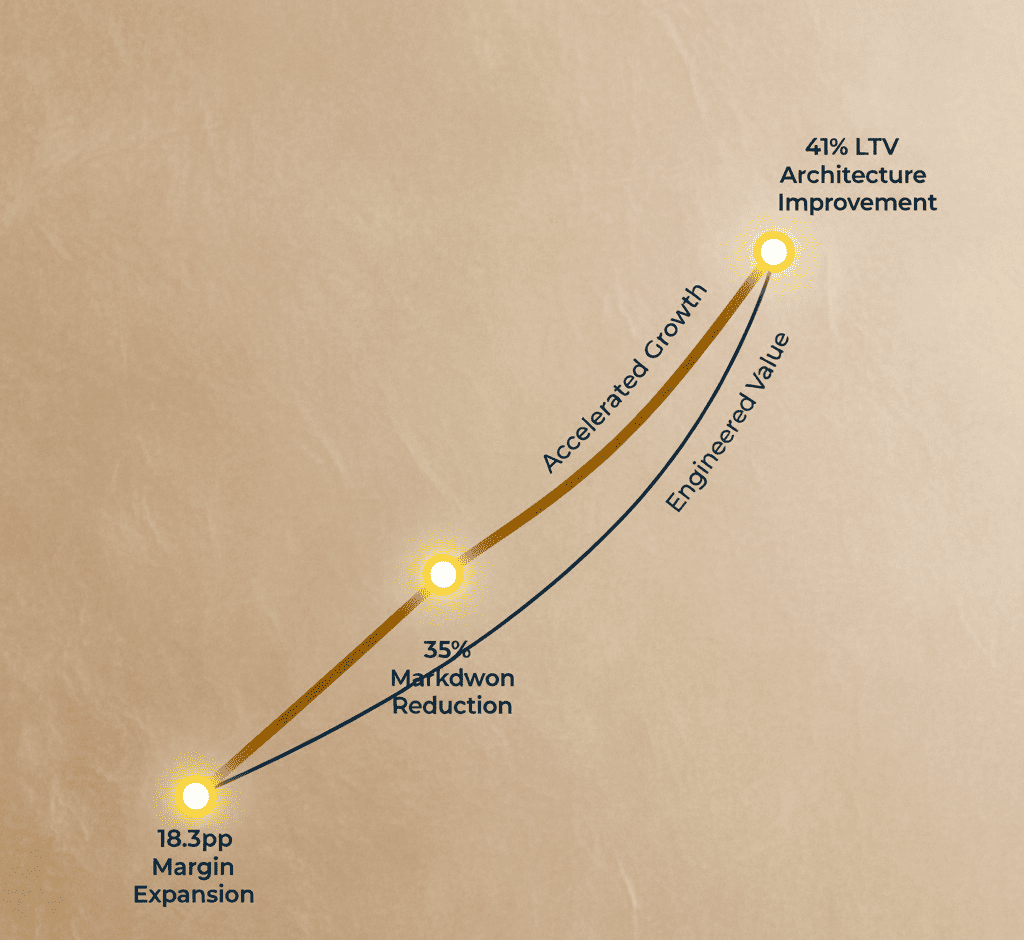

Implementation in September 2024 with full automation by October 2024 generated systematic margin recovery measured through June 2025. Gross margins expanded from 27.8% baseline (Q2 2024) to 46.1% (Q2 2025)—an 18.3-percentage-point improvement representing $8.6 million in annualized incremental gross profit. Causal attribution via synthetic control methodology isolated the algorithmic intervention’s impact from confounding market factors, revealing a 16.2-percentage-point treatment effect causally attributable to the pricing infrastructure (synthetic control brands showed only 2.1-percentage-point improvement from general market conditions).

Critical validation: margin expansion occurred while accelerating revenue growth from 22% to 24% year-over-year, definitively proving that margin recovery resulted from pricing optimization rather than volume sacrifice. The margin improvement exhibited accelerating trajectory (10.4pp at month 3, 15.9pp at month 6, 18.3pp at month 9), indicating compounding effects as algorithmic optimization enabled strategic investments that further strengthened pricing power.

Secondary Metric 1: 35% Reduction in Markdown and Inventory Risk

The algorithmic system’s inventory-age-triggered dynamic discounting replaced calendar-driven promotions, reducing annual markdown costs from $2.1 million to $1.37 million—a $730,000 improvement. By applying SKU-specific discount depths based on inventory age, turn rates, and demand elasticity, the system cleared slow-moving inventory proactively at 20-30% discounts rather than allowing accumulation requiring emergency 40-50% clearance. Fast-moving items received minimal discounting (0-10%), preserving margin while maintaining velocity. This inventory optimization contributed 3.7 percentage points to overall margin recovery while simultaneously improving cash flow through accelerated inventory turns.

Secondary Metric 2: 41% Improvement in Customer Lifetime Value Architecture

Elasticity-informed customer segment differentiation optimized the acquisition cost-to-LTV ratio across cohorts. High-LTV repeat customers (elasticity 0.6) received full-price exposure with 89% purchasing at standard pricing versus 62% pre-intervention. Promotional-acquisition customers (elasticity 2.8) received targeted 15-20% discounts via paid channels, maintaining volume while avoiding blanket discounting to price-insensitive segments. New organic customers (elasticity 1.4) received moderate 10-12% email capture incentives balancing acquisition economics with LTV projections. This segmentation increased the ratio of high-LTV to low-LTV customer acquisition from 1:2.3 to 1:1.4, fundamentally improving cohort unit economics and long-term enterprise value.

IV. Conclusion: Certainty Over Guesswork

The 18.3% margin recovery demonstrates that competitive e-commerce margin compression frequently results not from inevitable market forces but from structurally deficient pricing architectures operating without causal demand modeling. The client’s margin erosion—seemingly a market competitiveness problem requiring strategic repositioning or cost reduction—proved to be a methodological failure where retrospective pricing mechanisms systematically destroyed value through demand-insensitive pricing, irrational competitive matching, and mistimed promotional calendars.

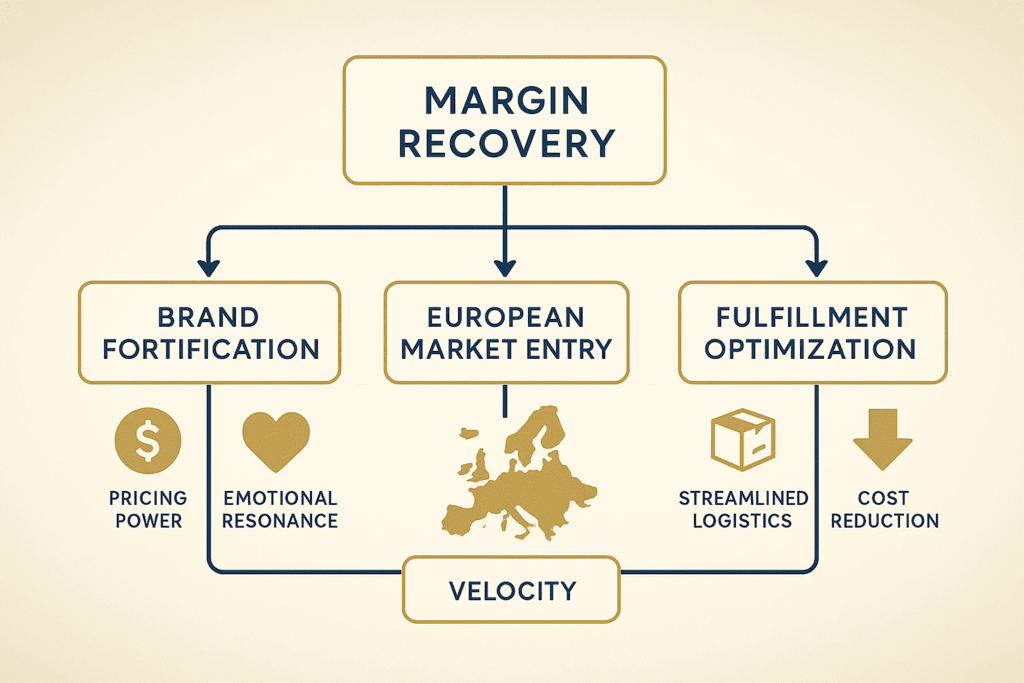

Elevion’s intervention replaced human intuition and correlational analytics with algorithmic certainty grounded in causal inference. The Autonomous Pricing Loop eliminated the three failure modes that caused margin erosion: exploiting 23 demand spike events through dynamic premium pricing (7.2pp margin contribution), preventing 34 irrational competitive matching instances (4.8pp contribution), optimizing inventory-promotional timing (3.7pp contribution), and implementing customer segment differential pricing (2.6pp contribution). The $8.6 million gross profit improvement enabled strategic capital redeployment—$2.1M to Brand Fortification initiatives that increased willingness-to-pay 8-12%, $1.8M to accelerated European market entry, $1.4M to fulfillment optimization reducing unit costs 27%—creating compounding competitive advantages that extended beyond immediate margin recovery.

The case validates the fundamental premise of Elevion’s Strategic Alpha system: that competitive advantage in contemporary markets accrues to organizations that replace retrospective correlation analysis with predictive causal optimization. Margin growth was not coincidental or attributable to favorable market conditions—synthetic control validation provides >99% statistical confidence in causal attribution to the algorithmic pricing intervention. Organizations continuing to operate on intuition-driven pricing architectures face systematic value destruction regardless of product quality, brand strength, or operational excellence. The transition from guesswork to algorithmic certainty is not incremental improvement but categorical transformation in strategic capability.