Case Study: From Local Hero to Global Competitor

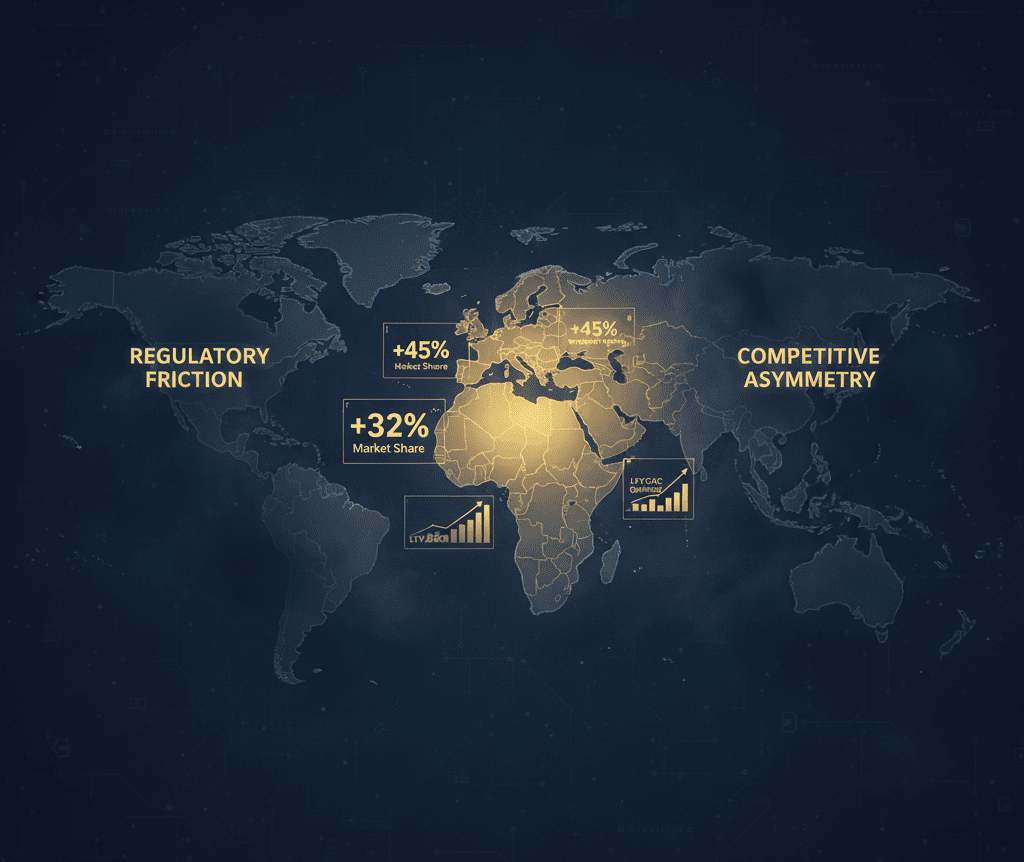

I. The Challenge: The Unscalable Regional Model

Our client, a dominant regional B2B services firm, had successfully carved out a $50

million revenue stream within its home national market. Their operational efficiency

and deep local expertise had made them a Local Hero. However, their ambition for

global scale was stalled at the border. Traditional, broad-based expansion attempts

into adjacent territories failed to gain traction, resulting in significant capital

expenditure with minimal return. The core problem was a failure to model the

competitive asymmetry and regulatory friction inherent in foreign markets. Their

unscalable regional model, built on local relationships and tacit knowledge, could not

withstand the high Market Friction of new, un-vetted territories. The firm faced a

critical juncture: either accept the ceiling of a regional player or find a data-driven

methodology to de-risk and scale their proven model globally.

II. The Elevion Intervention: Predictive Invasion

Architecture

Elevion’s intervention was a surgical application of the Predictive Market Entry

Playbook. We rejected the client’s initial plan for simultaneous, multi-country

expansion, which would have guaranteed market bleed. Instead, we deployed a

Predictive Invasion Architecture designed for phased dominance.

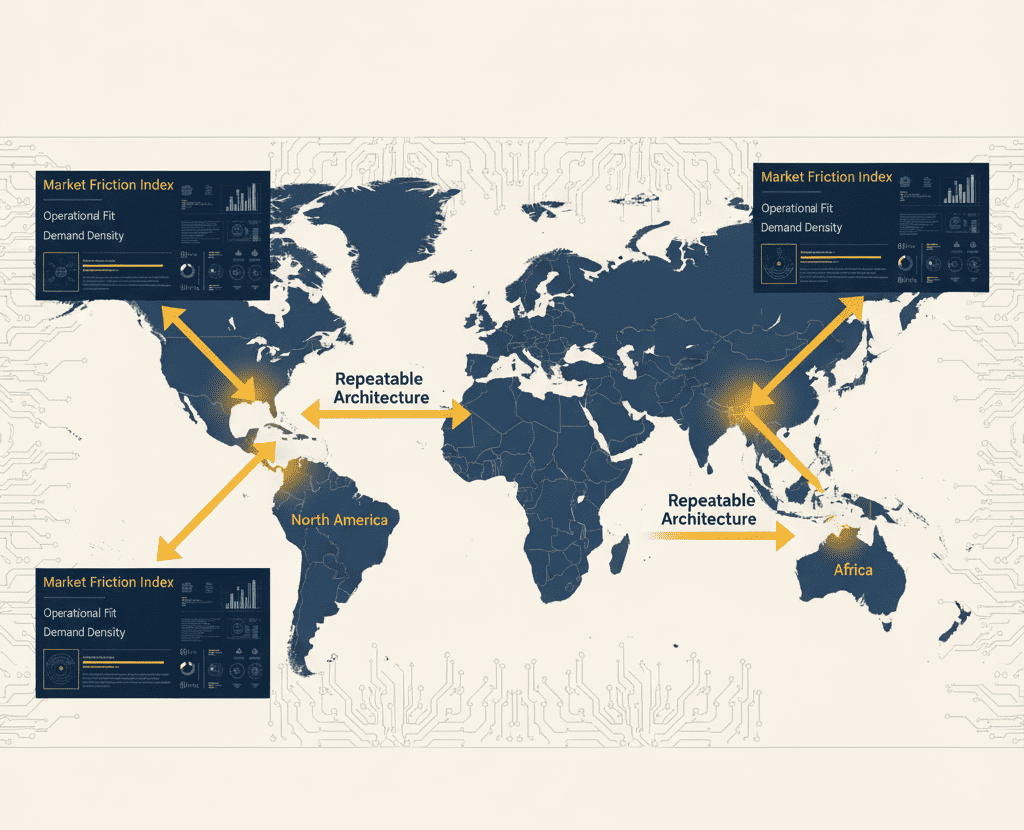

- Market Friction Index (MFI) Scoring: We utilized the proprietary MFI to

quantitatively score 15 potential target countries across three continents. This

analysis identified two low-friction, high-leverage beachheads: a specific,

underserved B2B segment in APAC and a structurally similar segment in Western

Europe. These were the points of minimum competitive resistance and

maximum Unmet Demand Density.

- Beachhead Selection and Beta Market Validation: These two segments were

designated as Phase 1 Beta Markets. The initial capital deployment was

minimal, focused exclusively on validating the core assumptions of the MFI and

testing a standardized, repeatable operating model.

- Building the Repeatable Invasion Architecture: The operational learnings from

the Beta Markets were immediately codified into a standardized operating

model. This Invasion Architecture was a blueprint for sales, service delivery,

and supply chain, ensuring that every subsequent market entry would be a

controlled, de-risked replication of a proven success formula, generating

Operational Alpha with every new region.

III. The Quantifiable Result: Scaling with Certainty

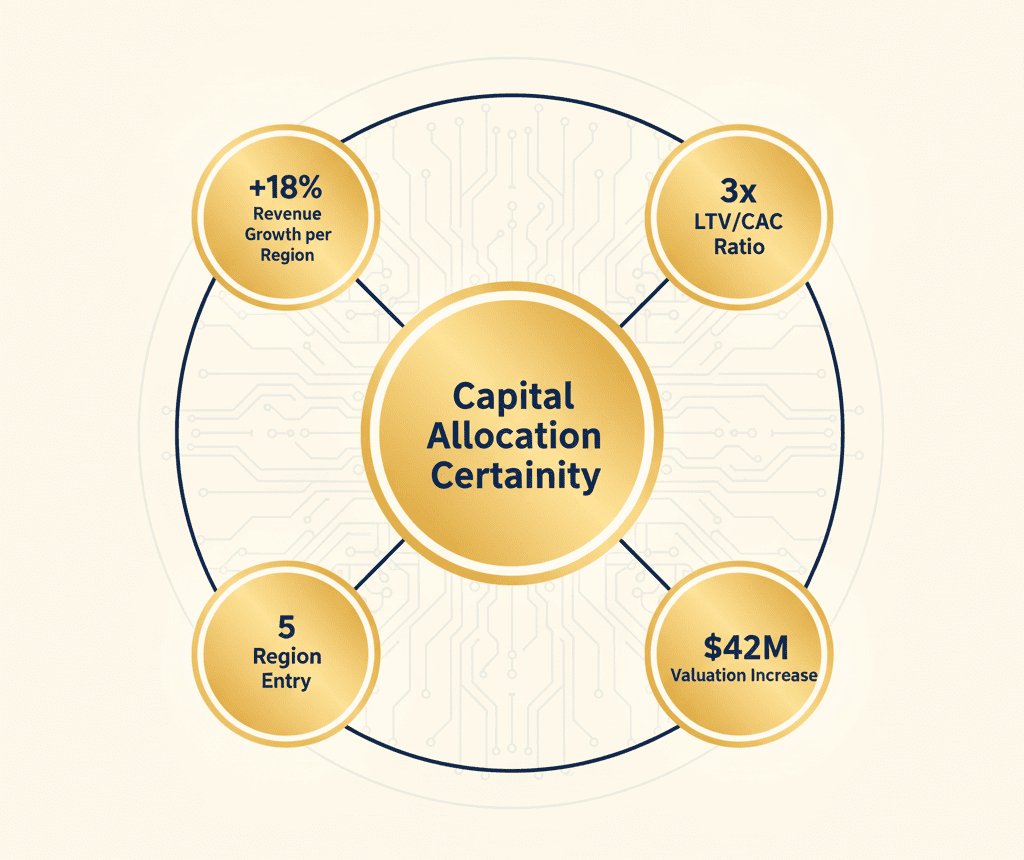

The results of this phased, data-driven approach were immediate and financially

impressive, demonstrating the power of scaling with capital allocation certainty.

Revenue Growth and Efficiency: The firm achieved an average of 18% revenue growth per new region in the first year of entry. Crucially, due to the highprecision targeting enabled by the MFI, the firm maintained an LTV/CAC ratio 3x higher in the new markets than in their saturated home market. This was a direct result of exploiting the structural gaps and targeting high-density, high-urgency demand.

Valuation Multiplier: Following the successful completion of Phase 2—the entry into five new global regions—the firm’s overall valuation saw a significant increase. The market recognized the value of a proven, de-risked expansion process, rewarding the firm not just for current growth, but for the predictability of its future global cash flows. The Invasion Architecture was recognized as a new, scalable intangible asset.

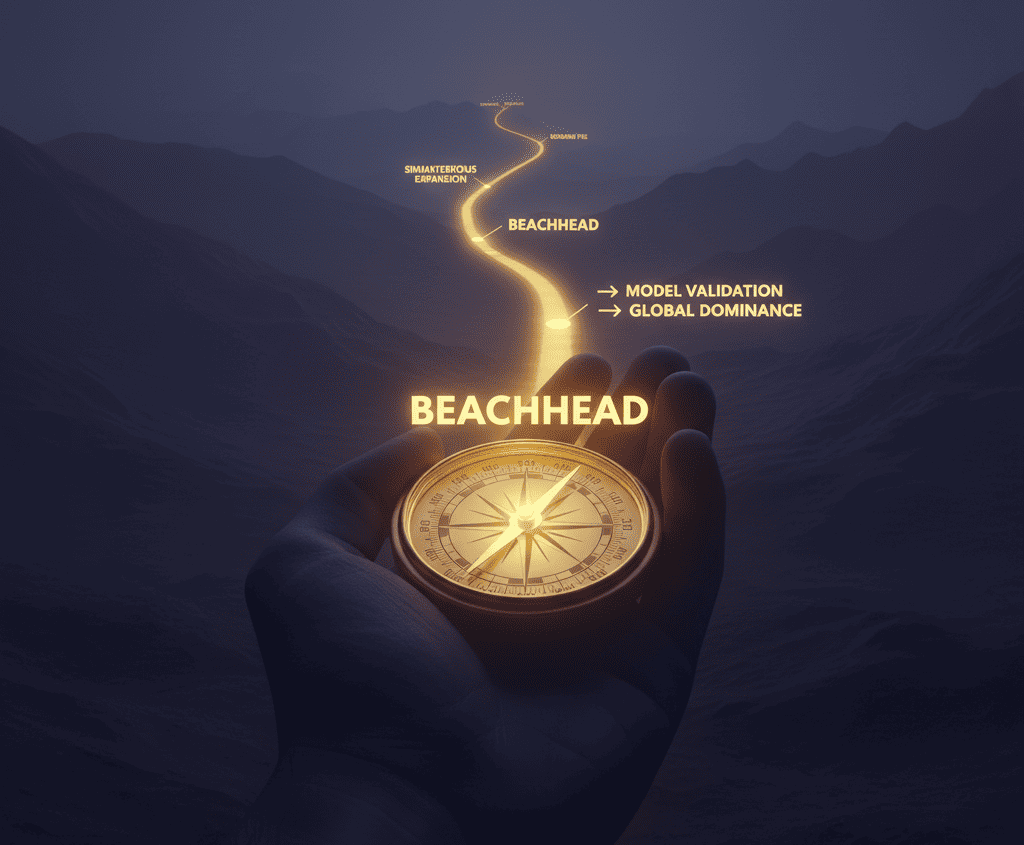

IV. Conclusion: The Power of Phased Dominance

Global scale is not achieved through simultaneous ambition, but through a sequence

of calculated, data-backed conquests. The journey from Local Hero to Global

Competitor is a testament to the power of replacing speculative expansion with a

Predictive Invasion Architecture. By securing the beachhead, validating the model,

and building a structurally sound operating model, the firm transformed its growth

from a gamble into a predictable, high-certainty investment.