De-Risking Expansion: A Playbook for

High-Certainty Global Growth

I. The Unacceptable Risk of Market Gambling

Global expansion, as traditionally executed, is often a high-cost, high-variance gamble.

It is characterized by an initial, large-scale capital deployment based on optimistic

projections, which inevitably encounters unmodeled competitive response and

unforeseen market friction. When these factors combine, the result is a rapid, nonrecoverable erosion of capital, a phenomenon we term unnecessary capital waste.

From the perspective of the Chief Risk Officer, this is an unacceptable risk profile. The

fiduciary duty of the executive team is to maximize shareholder value while

minimizing exposure to preventable downside. When predictable data and advanced

predictive modeling techniques exist—as they do today—to quantify and mitigate

these risks, the failure to employ them constitutes a failure of fiduciary duty.

The traditional approach treats market entry as a lottery ticket, where the cost of the

ticket is the initial investment. Elevion rejects this model. We mandate that every

expansion decision must be treated as a calculated capital allocation, where the

downside is protected by a predictive safety architecture and the return is secured

by data-backed certainty.

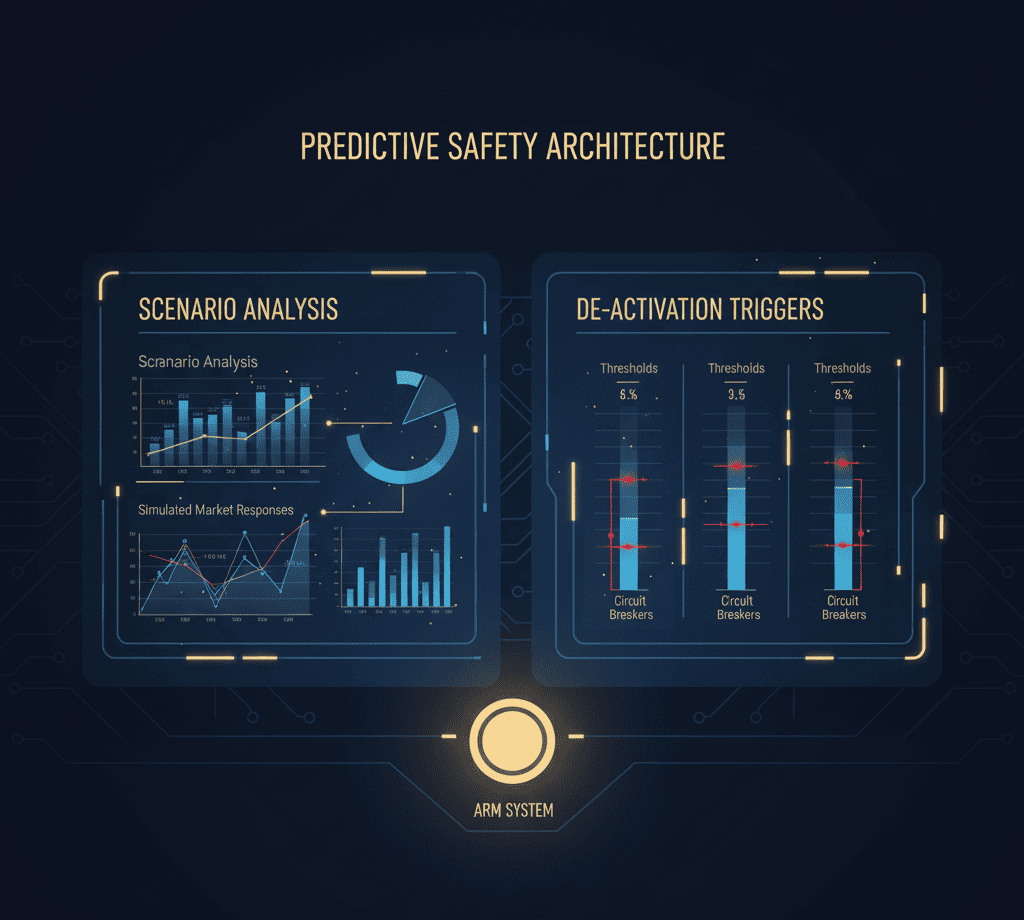

II. Governance First: The Predictive Safety

Architecture

Elevion’s methodology inverts the traditional expansion model by placing

Governance First. We do not execute until the safety architecture is fully modeled and

implemented. This architecture is built on two core components: Predictive Scenario

Analysis and De-Activation Triggers.

Predictive Scenario Analysis

Before a single dollar is deployed, we engage in rigorous Predictive Scenario

Analysis. This involves using advanced causal models to simulate the full spectrum of

competitive and market responses, with a specific focus on downside protection.

- Worst-Case Modeling: We model the most aggressive, resource-intensive competitive counter-response possible (e.g., a sustained price war, a preemptive acquisition of a key supplier).

- Capital-at-Risk Quantification: This analysis quantifies the maximum potential capital-at-risk under the worst-case scenario. This figure is the true cost of the investment, allowing the executive team to make a decision based on a fully hedged risk profile.

- Strategic Utility: By knowing the worst-case outcome, the firm can establish the necessary governance threshold for the investment, ensuring that the potential return is sufficiently high to justify the fully modeled risk.

Setting De-Activation Triggers

The De-Activation Trigger is the ultimate mechanism for capital preservation. These

are pre-defined, quantitative governance thresholds that, when breached, mandate

an immediate, controlled exit or pivot.

| Trigger Metric | Threshold Example | Fiduciary Action |

| Market Friction Index (MFI) | Observed MFI exceeds modeled MFI by 20% for two consecutive quarters. | Controlled Pivot: Immediate cessation of further capital deployment and redirection of resources to a lower-MFI beachhead. |

| Time to Local Dominance (TTLD) | TTLD exceeds the modeled timeline by 50%. | Strategic Retreat: Execution of a preapproved, capital-preserving off-ramp to minimize further loss. |

| Competitive Response Beta | Observed competitive response intensity exceeds the modeled worst-case scenario. | Circuit Breaker Activation: Immediate freeze on all non-essential operational spending in the market |

These triggers eliminate the emotional, sunk-cost bias that plagues traditional

expansion. They ensure that the decision to exit is a quantitative, pre-approved act of

capital allocation certainty.

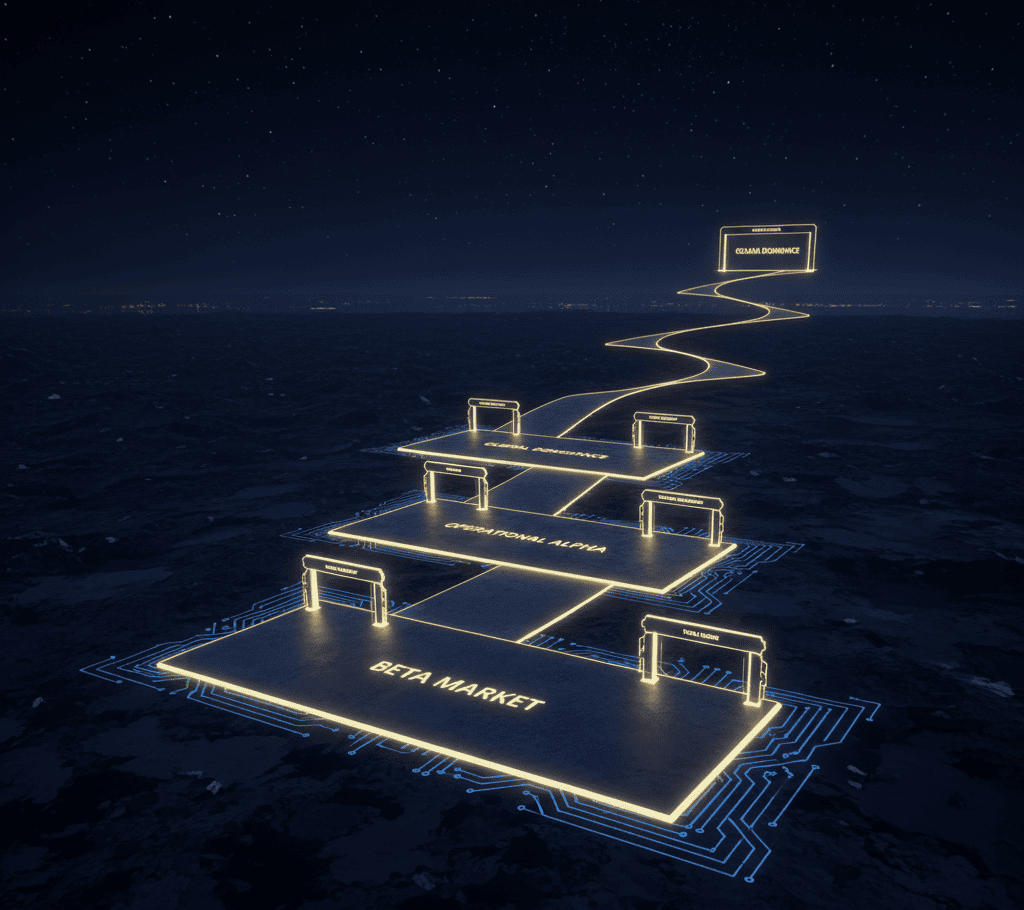

III. The Capital Allocation Roadmap: From Beta Test to Dominance

Expansion must be treated as a phased, incremental capital investment, not a single,

monolithic expenditure. The Capital Allocation Roadmap mandates a progression

from a contained Beta Market to full-scale dominance.

The Beta Market (The Beachhead)

The initial market entry must be a Beta Test—a contained, low-capital deployment in

a carefully selected Beachhead (as defined by the lowest MFI score).

- Purpose: The Beta Market is not primarily for revenue generation; it is for model validation. The small, contained investment is designed to test the core assumptions of the predictive models (MFI, Competitive Response) against realworld market friction.

- Capital Allocation: Only the minimum viable capital required to validate the model is deployed. This minimizes the initial investment risk and maximizes the learning return.

- Success Metric: The Beta Test is successful not when it generates profit, but when the observed market friction and competitive response align with the Predictive Scenario Analysis.

Scaling with Capital Allocation Certainty

Only after the predictive models have been validated in the Beta Market is the next

phase of capital deployed. This phased approach ensures that subsequent, larger

investments are made with a high degree of capital allocation certainty.

The firm scales rapidly from the secure Beta Market, leveraging the validated model to

achieve Operational Alpha and unassailable local dominance. This is a strategy of

predictable investment returns, where each subsequent capital deployment is derisked by the success of the preceding, smaller phase.

IV. Conclusion: Certainty in Capital Deployment

The goal of the Chief Risk Officer is not merely success, but the certainty of outcome.

The De-Risking Expansion Playbook replaces the gamble of global growth with a

rigorous, data-backed process that ensures downside protection and predictable

investment returns.

By adopting a Governance First approach, implementing Predictive Scenario

Analysis and De-Activation Triggers, and treating the initial market entry as a

contained Beta Test, the executive team transforms expansion from a speculative

venture into a calculated, fiduciary-sound capital allocation. This is the only path to

achieving high-certainty global growth.

Final Declarative Statement: The true measure of strategic leadership is not the

audacity of the expansion, but the rigor of the governance that secures the capital.