Case Study: Achieving a 7x ROAS in 90 Days

I. The Challenge: Profitable, But Untrustworthy Growth

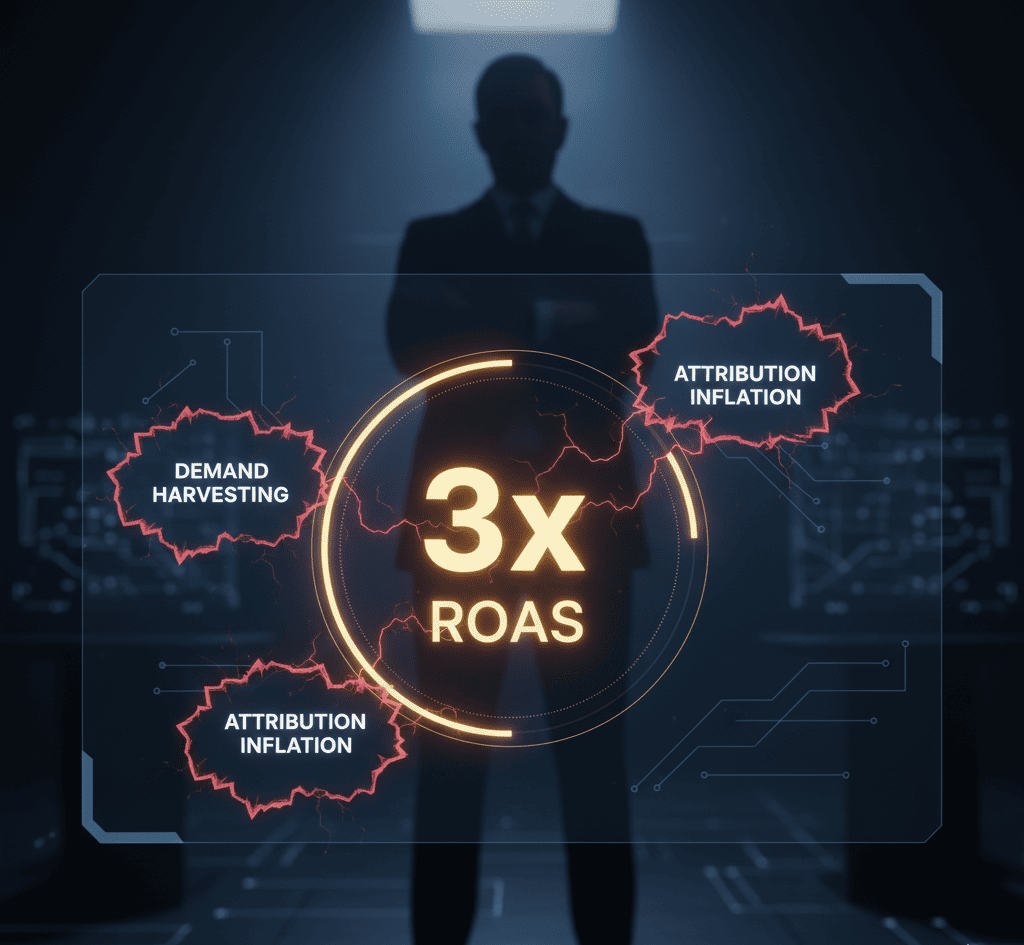

A rapidly scaling direct-to-consumer subscription business generating $40M in annual recurring revenue faced a crisis of confidence in their digital advertising performance. Platform-reported metrics suggested a healthy 3x return on ad spend, creating the illusion of sustainable growth. However, the company’s CFO harbored deep suspicions about the true financial contribution of their media investments. The fundamental concern was demand harvesting—the platforms were taking credit for conversions that would have occurred organically, while the actual incremental value generated remained unknown.

This uncertainty created a cascading risk problem. Without clarity on true causal impact, the executive team couldn’t distinguish between genuinely incremental revenue and mere attribution inflation. Worse, traditional optimization approaches focused exclusively on cost-per-acquisition efficiency were systematically selecting for low-lifetime-value customers—users who converted cheaply but churned quickly or generated minimal long-term revenue. The business was growing, but on an unstable foundation. Media spend had plateaued at $8M annually because leadership refused to increase investment without statistical proof of genuine incrementality. Growth was constrained not by market opportunity, but by measurement uncertainty.

II. The Elevion Intervention: Enforcing Causal Accountability

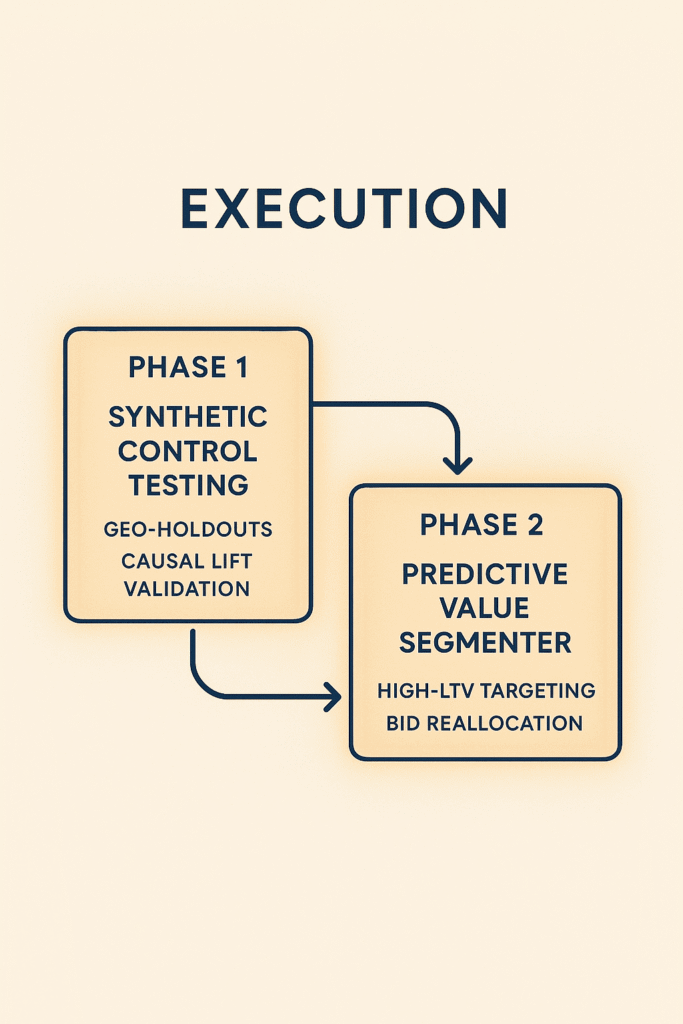

Elevion deployed the Causal Execution Framework, replacing platform-reported attribution with rigorous incrementality measurement and predictive value targeting. The intervention proceeded in two critical phases.

Phase One: Establishing Ground Truth Through Synthetic Control Testing. Elevion implemented holdout-based synthetic control experiments across geographic markets and audience segments to isolate the true causal impact of media spend. The results confirmed the CFO’s instincts: the actual incremental ROAS was only 1.5x—less than half of what platforms reported. Approximately 50% of attributed conversions would have occurred without any advertising exposure. This finding immediately recalibrated the entire investment thesis, revealing that optimization toward platform-reported efficiency metrics was systematically destroying capital efficiency.

Phase Two: Deploying the Predictive Value Segmenter (PVS). With causal measurement infrastructure established, Elevion implemented the Predictive Value Segmenter to fundamentally restructure bidding strategy. Rather than optimizing for low-cost conversions, the PVS identified and prioritized audience segments demonstrating statistically significant indicators of high lifetime value—behavioral patterns, contextual signals, and cohort characteristics that predicted 90-day and 365-day customer value. Bid modifiers were aggressively adjusted to capture high-LTV users while systematically reducing spend on segments that generated cheap acquisitions but poor retention economics. Every dollar was reallocated based on predictive LTV contribution, not conversion volume.

III. The Quantifiable Result: Scaling with Certainty

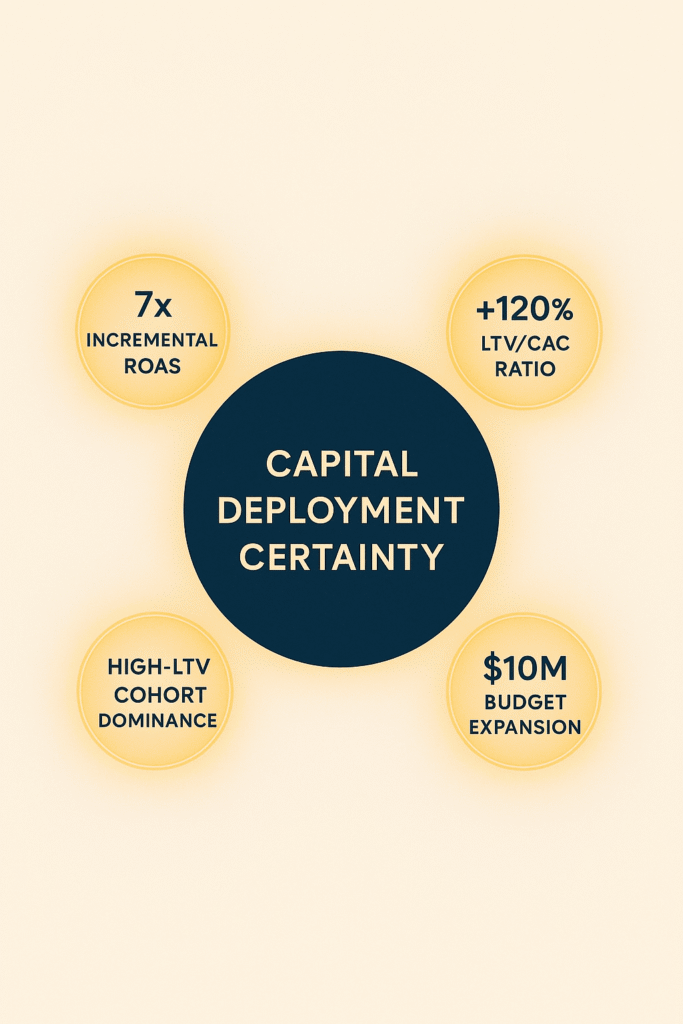

Within 90 days of implementing the Causal Execution Framework, the business achieved a 7x incremental ROAS measured by customer lifetime value—a 367% improvement over the baseline 1.5x true ROAS. This wasn’t merely an attribution reporting change; incrementality testing confirmed that these gains represented genuine, causally validated revenue growth driven by media spend.

The secondary transformation proved equally consequential. The LTV/CAC ratio for newly acquired customer cohorts increased by 120%, fundamentally de-risking the customer acquisition model. High-LTV segments now dominated the acquisition mix, replacing the low-quality volume that had previously diluted cohort economics. This statistical certainty enabled the executive team to immediately authorize a $10M increase in media budget—more than doubling annual ad spend—with confidence that every incremental dollar would generate predictable, high-yield returns. Media spend transformed from a constrained, speculative investment into the company’s highest-performing capital deployment vehicle.

IV. Conclusion: Precision Execution as a Financial Asset

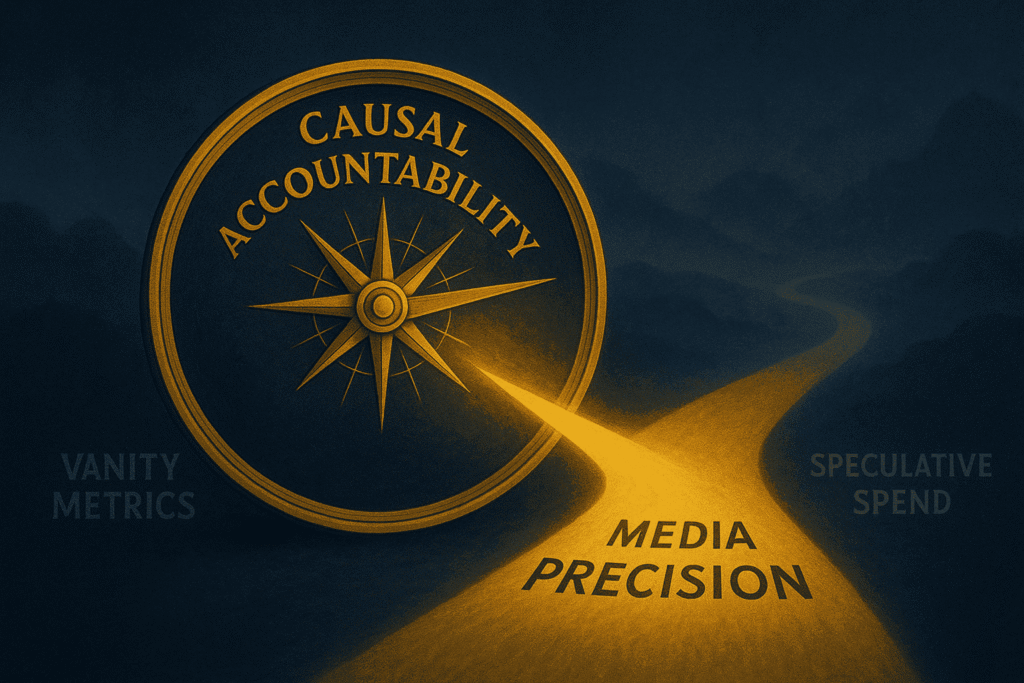

Rapid, profitable growth doesn’t require larger budgets—it demands deploying capital with statistical certainty. The Causal Execution Framework eliminates measurement ambiguity, replacing platform-reported vanity metrics with rigorous incrementality testing and predictive value targeting. By enforcing causal accountability at every stage of the execution cycle, Elevion transformed this client’s media spend from a speculative cost center into a predictable, high-yield financial asset. Precision execution, backed by mathematical proof, is the only sustainable path to scaling profitably in an attribution-distorted advertising landscape.