The Agency Dilemma: Deconstructing the Failure of the Billable Hour

Why the Billable Hour Model is Structurally Designed to Destroy Enterprise Value

BY ELEVION STRATEGIC AUDITORS | INDUSTRIAL ECONOMICS DIVISION

Every hour your agency bills you is an hour they’re incentivized NOT to

make you more efficient.

This is not a conspiracy; it is basic economics. In the current landscape of professional services, a quiet crisis is eroding the balance sheets of mid- market firms. It is not a crisis of talent, nor is it a crisis of technology. It is a crisis of incentive architecture.

Consider the following scenario: A CEO of a growing SaaS company allocates a $500,000 annual budget to a digital transformation agency. The mandate is clear—improve operational velocity and drive revenue. Yet, twelve months later, the agency’s invoices are paid in full, reports are filed with beautifully designed graphs, but the company’s enterprise value remains stagnant. The agency claims they worked hard. The timesheets prove it. But the ROI is negative.

Why does this happen with such predictable regularity? Because the agency model contains a fundamental, structural flaw that penalizes efficiency and rewards complexity. When you pay for time, you are purchasing effort, not outcomes.

And in a world where speed and precision are the currencies of growth, paying for “effort” is a liability.

At ELEVION, we have audited dozens of these relationships. The forensic evidence is always the same: the vendor was optimizing for their billing utilization, while the client was praying for a business breakthrough. These two goals are mathematically mutually exclusive.

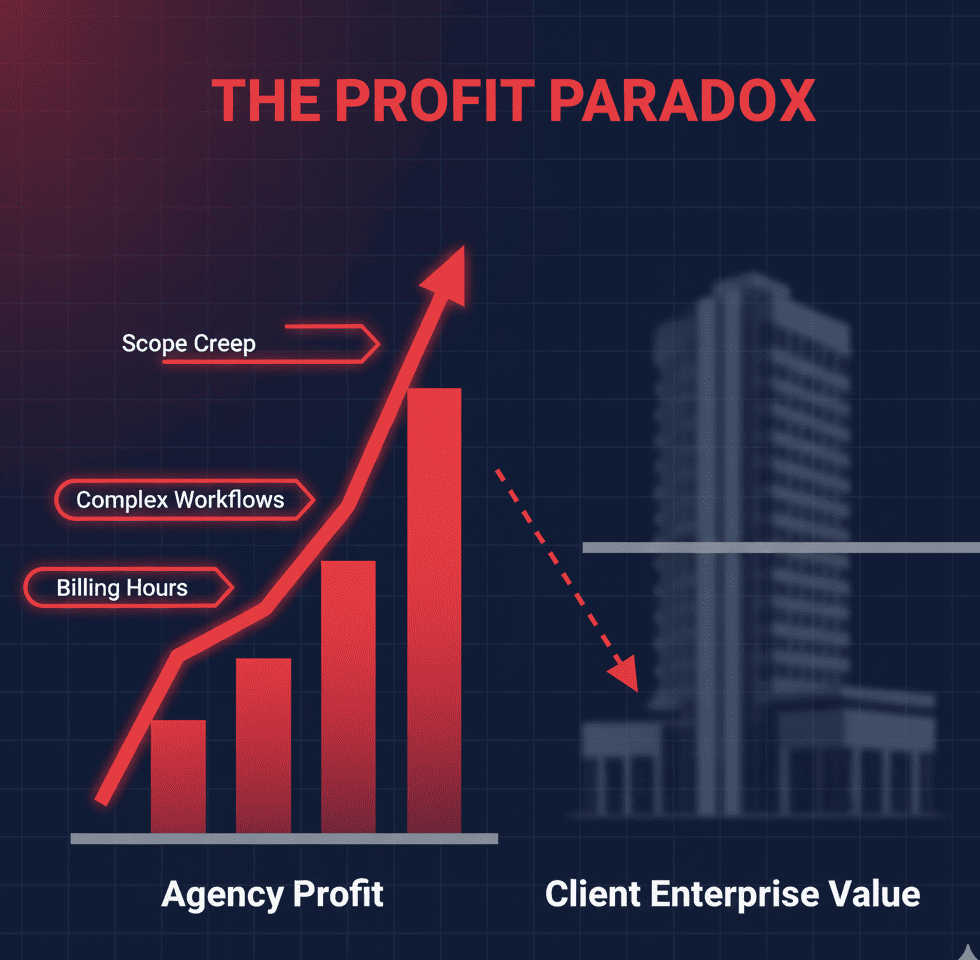

The Agency-Principal Conflict: When Your Vendor Profits from Your Inefficiency

In economic theory, the Principal-Agent Problem describes a conflict of interest inherent in any relationship where one party is expected to act in another’s best interest. In the context of modern business services, this conflict has metastasized into a profit model that actively damages the client.

The traditional agency is an engine designed to consume hours. Its inventory is time. If an agency finishes a project in 10 hours instead of 100, they lose 90% of their revenue. Therefore, structurally, an agency is financially punished for being efficient. They are incentivized to solve problems in the slowest, most labor-intensive way possible that remains just below the threshold of client termination.

This misalignment manifests as “Scope Creep”—often treated as an annoyance, but in reality, it is a feature of the agency business model, not a bug. Agencies build complex workflows, insist on unnecessary “alignment meetings, ” and demand endless rounds of revisions not because these activities drive value, but because they drive billing.

We see this in software development shops that prefer custom coding over low-code solutions, marketing firms that prioritize high-labor content production over automated nurturing sequences, and consultancies that produce 200-page decks when a 2-page memo would suffice.

"An Agency Optimizing For its Own Revenue will never optimize for your efficiency. The more problems you have, the more profitable they become "

When your vendor profits from the friction in your business, they have zero incentive to apply grease. They become architects of complexity, building labyrinths that require their ongoing guidance to navigate. This creates a dependency loop where the client pays the agency to manage the very complexity the agency created.

The Commoditization Trap : How “Creative-as-a-Service” Became a Race to the Bottom

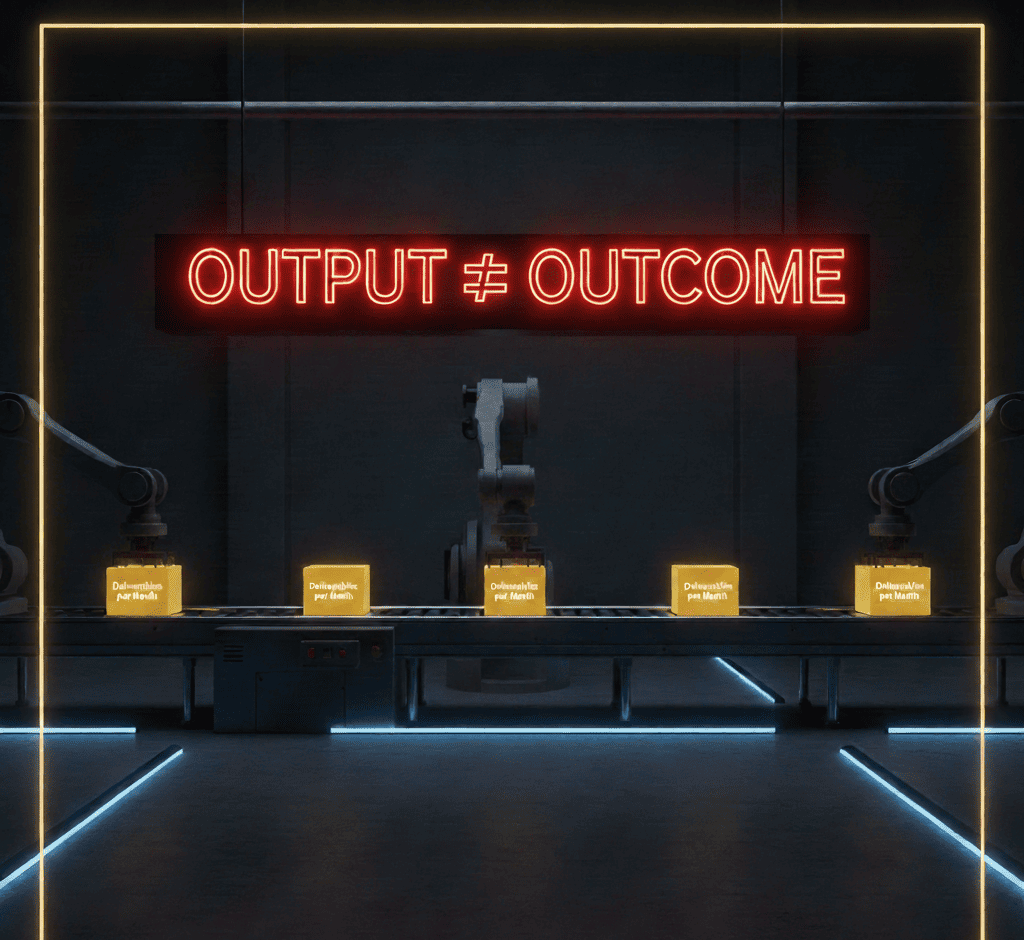

The proliferation of the “Service-as-a-Service” economy has further degraded the quality of strategic partnership. We have entered the era of the Commoditization Trap.

Marketplaces like Upwork, Fiverr, and a host of “unlimited design”subscription services have trained the market to view professional output as a widget. The focus has shifted entirely from “Return on Investment” to “Deliverables per Month.” This industrialization of creativity has led to a race to the bottom, where agencies compete on price rather than value creation.

When a service is commoditized, the provider must prioritize volume over depth. They cannot afford to think deeply about your business model, your unit economics, or your long-term strategy. They must simply ” feed the beast” of the content calendar or the sprint backlog. Output becomes detached from outcome.

We see marketing reports that celebrate “15 blog posts created” or ” 40 social media assets deployed” with no correlation to lead quality or customer acquisition cost. The agency fulfills the contract by delivering the thing, regardless of whether the thing actually moves the needle

This trap is dangerous because it looks like productivity. It feels like work is getting done. But activity is not achievement. In this commoditized model, strategic thinking is rare because it is expensive and hard to bill for. It is easier to sell 100 hours of graphic design than 10 hours of strategic restructuring, even if the latter is worth 100x more to the client.

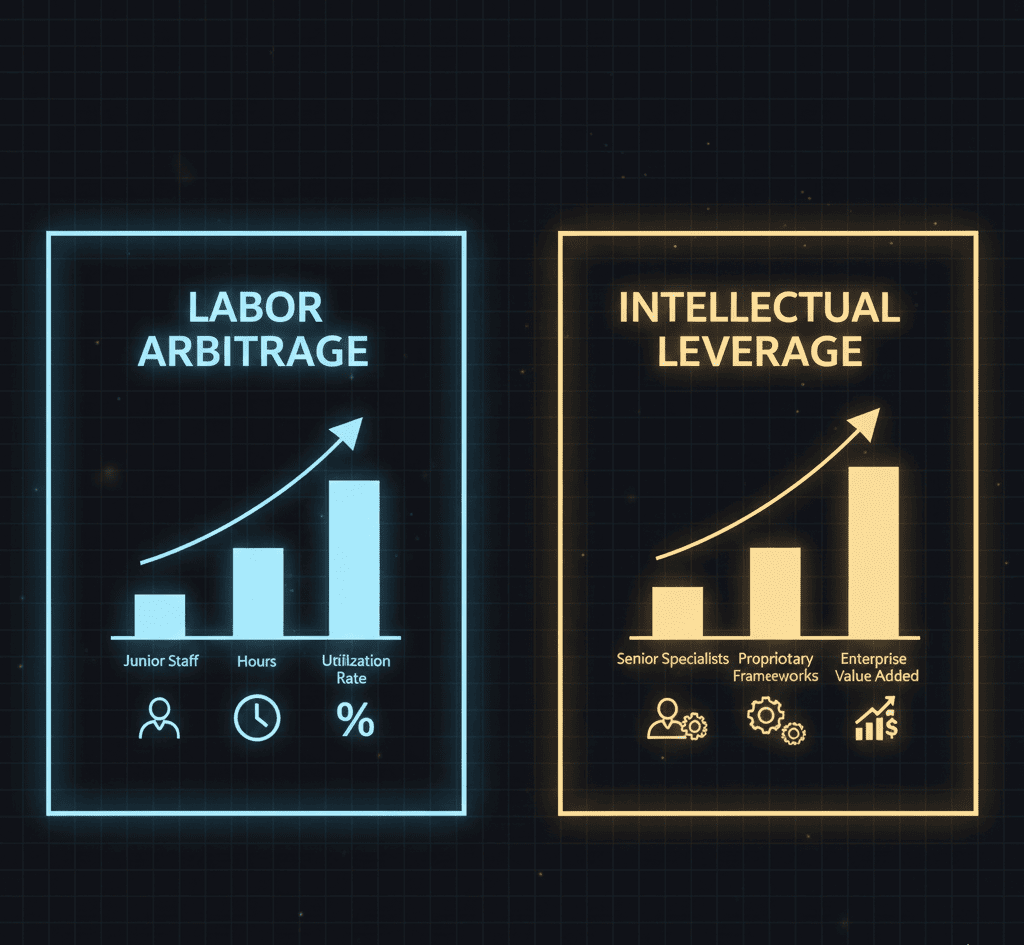

Labor Arbitrage vs. Intellectual Leverage: The

Billion-Dollar Distinction

To understand why most agency relationships fail to deliver enterprise value, we must distinguish between two fundamentally different business models: Labor Arbitrage and Intellectual Leverage. Most agencies are in the business of Labor Arbitrage. They hire junior talent at cost $X, and lease them to you at cost $3X. The value proposition is “we have hands so you don’t have to hire them.” This is a procurement solution, not a growth solution. It is renting capacity. True strategic partners provide Intellectual Leverage. They bring proprietary systems, verified frameworks, and senior-level insight that multiplies the output of your existing resources. They don’t just sell

“doing”; they sell “knowing how.”

| Labor Arbitrage (TraditionalAgency) | Intellectual Leverage (Strategic Partner) |

| Sells hours and headcount. | Sells out comes, systems, and veltociy. |

| Profits from inefficiency and extended timelines. | Profits from speed and impact |

| “What do you want us to do?” | “Here is what needs to be done.” |

| Metric: Utilization Rate. | Metric: Enterprise Value Added. |

| Staffed by junior generalists. | Staffed by senior specialists. |

The tragedy is that most agencies claim to offer Intellectual Leverage while operating a Labor Arbitrage boiler room. They pitch strategy in the boardroom but deliver junior execution in the trenches. This bait-and- switch leaves clients paying premium rates for commoditized labor.

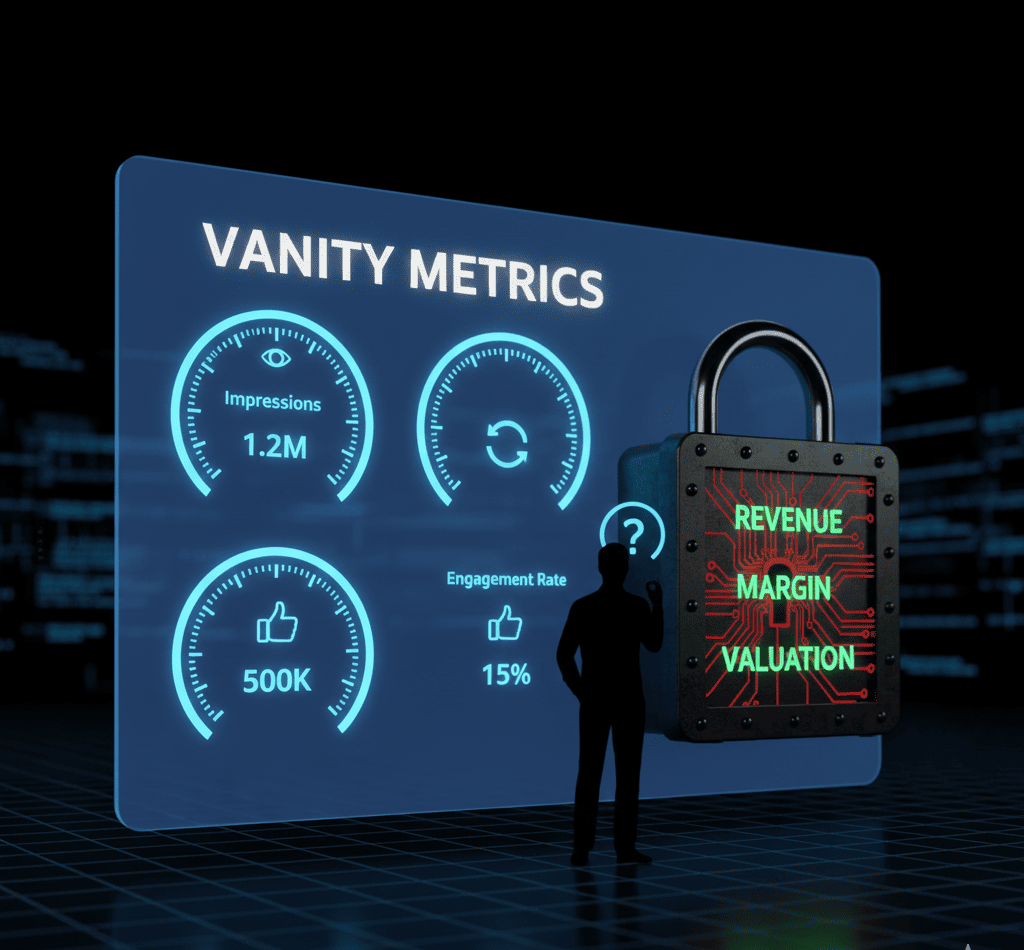

The Black Box Problem: How Agencies Hide

Behind Vanity Metrics

If the incentives are misaligned and the model is commoditized, how do agencies survive? They survive by controlling the scoreboard. We call this the Black Box Problem.

Because there is no clear line from agency activity to enterprise value in the traditional model, agencies invent intermediate metrics to justify their fees. These are Vanity Metrics: impressions, likes, engagement rates, “brand lift,” or “story points completed.”

These metrics are designed to always go up and to the right, regardless of the business’s financial health. An ad agency can report a 20% increase in click-through rates while the client’s net margin collapses. A development shop can report 99% sprint completion while the product achieves zero market fit.

By keeping the performance data inside a “Black Box”—or by flooding the client with so much raw data that insight is impossible to extract— agencies prevent true auditing of their ROI. They control the narrative. “The campaign is working, ” they say, pointing to a graph of impressions. “We just need more budget to unlock the conversions.”

This lack of transparency allows the agency to hide the fact that they are essentially burning cash. Without a direct link to revenue, margin, or valuation, the client is flying blind, trusting the vendor’s self-reported grades.

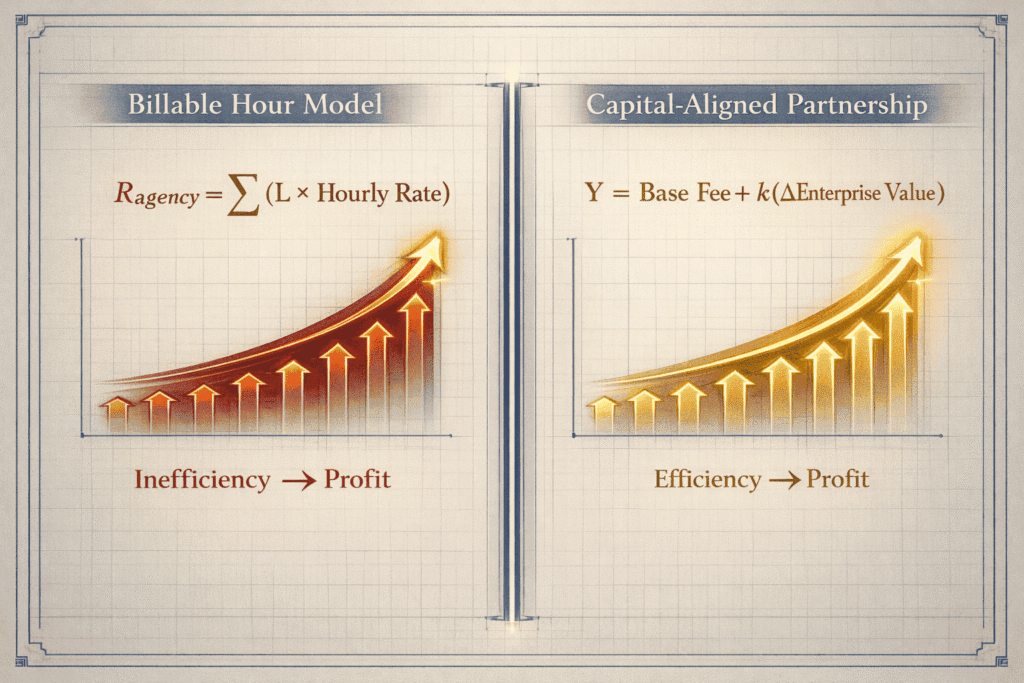

The Mathematics of Misalignment: Why the Billable Hour is Structurally Broken

To rigorously prove why this model fails, we must look at the underlying math. We do not need anecdotes; we need equations. The traditional agency model (M_a) is built on a linear relationship between Labor (L) and Revenue (R), creating a conflict with the Client’s need for Efficiency (E):

Ragency =∑(L × Hourly Rate)

In this model, the agency’s profit increases as efficiency decreases. The Strategic Partnership Model (M_s) must pivot to an Outcome-Based Yield (Y), where the partner’s compensation is a function of the Alpha (α) generated for the client:

Y = (Base Fee) + k(ΔEnterprise Value)

Where k represents the performance-sharing coefficient. This aligns the ‘Agency’ with the ‘Principal,’ turning a vendor relationship into a capital-aligned partnership.

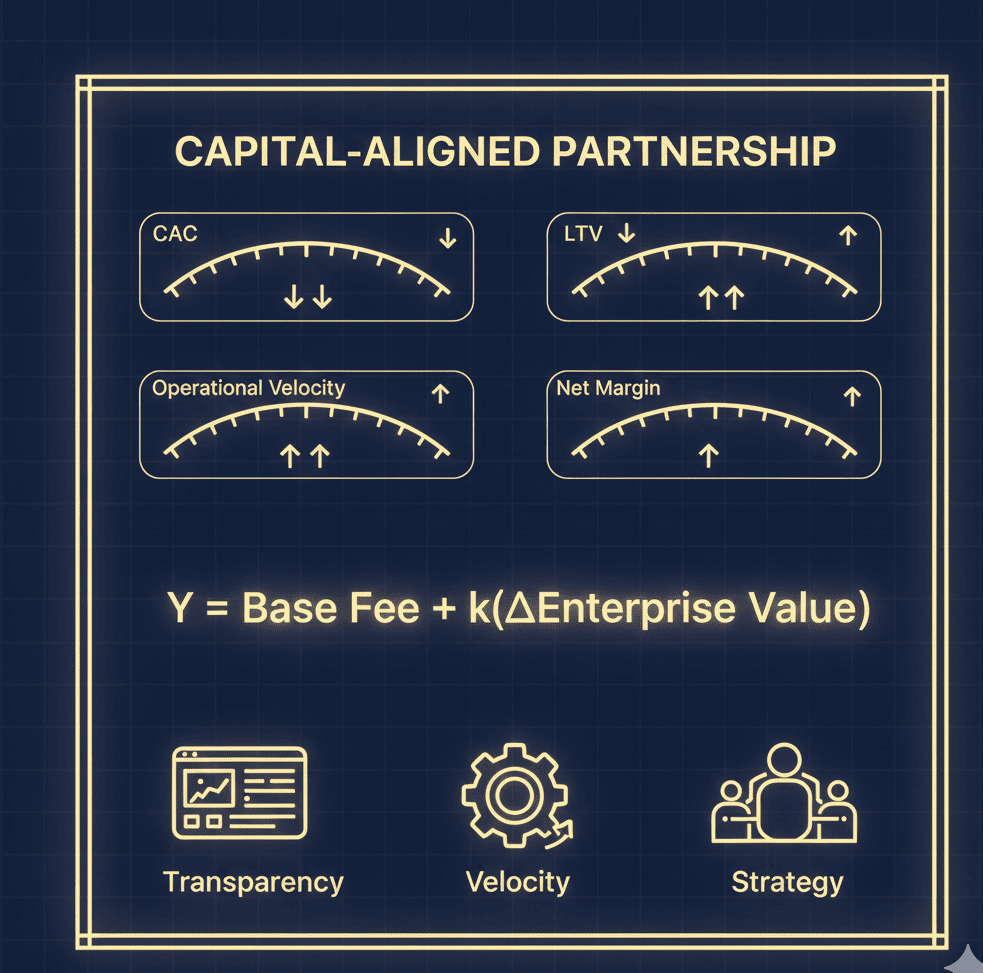

The ELEVION Model: Capital-Aligned Strategic Partnership

At ELEVION, we recognized that the traditional model was broken beyond repair. You cannot fix a structural flaw with better project management software or nicer account managers. You must tear down the structure.

We built the Capital-Aligned Strategic Partnership model to solve the Agency Dilemma. We do not sell hours. We do not sell “creatives.” We act as Industrial Architects for your business growth.

Our engagement models are designed around the second equation. We baseline your current metrics—Customer Acquisition Cost (CAC), Lifetime Value (LTV), Operational Velocity, and Net Margin. We then deploy high-leverage systems to improve these metrics. Our compensation is tied to the measurable lift in these KPIs.

This changes the dynamic entirely:

- Transparency: We share a single dashboard. There are no vanity metrics, only business metrics.

- Velocity: Because we are not billing by the hour, we are incentivized to solve problems instantly. If we can automate a process in 2 days that used to take you 2 months, we both win.

- Strategy: We operate as an extension of your executive suite. We are not order-takers; we are architects. We challenge your assumptions because your growth is our growth.

We replace ” Agency Bloat” with “Strategic Precision.” We do not want to be a permanent line item on your P&L that grows indefinitely. We want to be the catalyst that permanently increases your valuation.

The Audit Questions: Are You Paying For Activity or Outcomes ?

As a founder, CEO, or COO, you have a fiduciary duty to audit your capital

allocation. It is time to look at your professional service spend with forensic scrutiny.

We invite you to run this simple Agency Audit Checklist on your current partners:

- ✓The Incentive Test: If they finish the project in half the time, do they make less money?

- ✓The Metrics Test: Do their monthly reports focus on their activity hours, posts, clicks) or your outcomes (revenue, margin, LTV)?

- ✓The Complexity Test: Over the last year, has working with them made your internal processes simpler or more complex?

- ✓The Talent Test: Are you interacting with the senior strategists you met during the sales process, or junior account managers?

- ✓The “k” Test: Do they have any compensation tied directly to the success of your business?

The Verdict: If your agency relationship looks more like the first formula than the second, it is time for a structural redesign.

You do not need more hours. You need more Alpha. You need a partner who understands the physics of growth and is willing to bet on their ability to deliver it.

Stop renting hands. Start building leverage.

Ready to restructure your growth architecture?

www.thinkelevion.com