The Strategic Alpha Engine: Market Entry & Asymmetric Growth

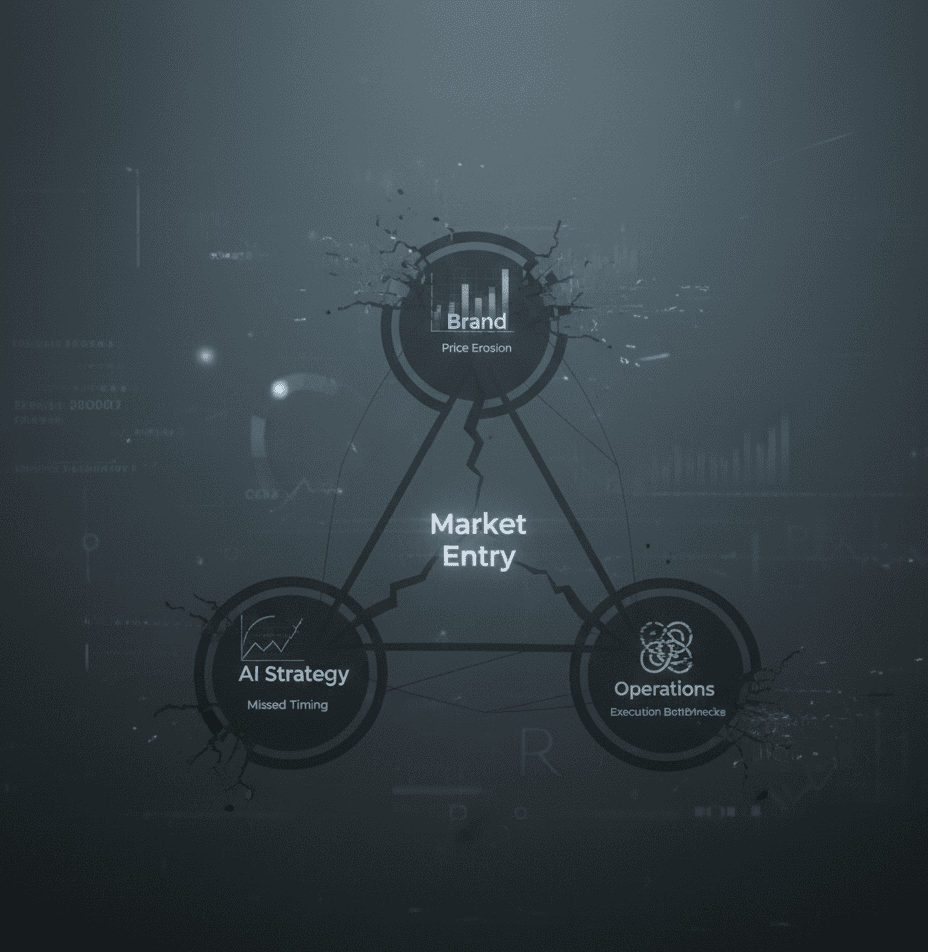

The Definitive Diagnosis: The Consensus-Driven Saturation Trap

Traditional market entry methodology operates on a catastrophic strategic fallacy: the belief that market attractiveness correlates with market size and existing validation. Legacy consulting firms guide founders toward consensus opportunities—markets with demonstrated demand, established competitive dynamics, and transparent customer acquisition pathways. This approach guarantees strategic mediocrity. By the time a market appears “attractive” in conventional analysis, asymmetric advantage has evaporated. You enter not as a category pioneer but as a marginal competitor, forced into a capital-intensive war of attrition against entrenched players with superior resources, established distribution, and embedded switching costs.

The resulting economics are structurally punitive: compressed margins from day one, customer acquisition costs that approach or exceed lifetime value, and growth velocity constrained by your ability to outspend competitors in a transparent bidding war for finite customer attention. This is consensus-driven saturation—the predictable outcome of entering markets that every other strategically competent firm has already identified. The opportunity cost is existential: while you burn capital fighting for incremental market share in visible battlegrounds, non-obvious strategic vectors with exponential return profiles remain undetected and unexploited.

The fundamental error is epistemological. Traditional market entry analysis is retrospective by design—it identifies opportunities by analyzing what exists rather than modeling what will exist. This creates systematic blindness to emerging needs, latent demand pools, and market discontinuities that will reshape competitive dynamics before your launch completes. Worse, it optimizes for consensus validation rather than predictive accuracy, leading founders to pursue markets where competitive intensity guarantees suboptimal returns regardless of execution quality.

Elevion’s Market Entry capability eliminates this structural deficiency through Predictive Alpha—the identification of non-obvious strategic vectors that exist in states of temporary informational asymmetry. Rather than entering markets everyone sees, we model markets only AI-driven causal inference can predict: unmet needs that will crystallize, regulatory shifts that will unlock trapped value, and technological convergences that will obsolete existing solutions. This is not opportunistic trend-chasing; it is the systematic exploitation of temporal advantage windows where limited competition and urgent unmet demand create the conditions for Asymmetric Growth.

The Elevion Methodology: Market Entry as a Systemic Advantage

Our Market Entry methodology operates as a predictive intelligence infrastructure that identifies, validates, and executes expansion into non-consensus strategic vectors with disproportionate return potential. This is not market research—it is the algorithmic discovery of opportunities invisible to traditional analysis:

Inputs: Predictive Alpha Scanning (Identifying Future Unmet Needs)

- Deployment of causal inference models that analyze behavioral signals, regulatory trajectories, and technological capability curves to identify needs that will emerge 12-36 months ahead of mainstream recognition

- Proprietary sentiment analysis across non-obvious data sources (niche communities, technical forums, regulatory comment periods, patent filings) to detect latent demand before it reaches conventional market research instruments

- Cross-sector pattern recognition that identifies analogous market evolutions in adjacent industries, revealing predictable demand emergence patterns that have yet to manifest in your target category

- Continuous scanning for market discontinuities—regulatory changes, technological breakthroughs, macroeconomic shifts—that will restructure competitive dynamics and create temporary windows of asymmetric opportunity

Process: Strategic Vector Modeling (Mapping the Fastest, Least-Contested Path)

- Synthetic Market Environment simulation that stress-tests thousands of potential entry strategies across probabilistic future scenarios, identifying the optimal combination of timing, positioning, and resource allocation

- Competitive blind spot analysis that reveals which strategic vectors are structurally invisible to incumbent players due to organizational inertia, cognitive bias, or business model constraints—these represent paths of least resistance for market disruption

- Strategic sequencing optimization that determines the precise order of capability development, partnership formation, and market messaging required to establish category leadership before competitors recognize the opportunity

- Capital efficiency modeling that maximizes growth velocity per dollar invested by identifying entry points where small initial advantages compound into insurmountable competitive moats through network effects, data accumulation, or ecosystem lock-in

Output: Optimized Launch Sequence and Competitive Disruption

- Detailed market entry blueprint specifying the causal pathway to market leadership, including precise timing windows, resource allocation optima, and contingency protocols for scenario deviations

- Competitive disruption roadmap that identifies which incumbent vulnerabilities to exploit, which customer segments to target for initial traction, and which strategic partnerships will accelerate market penetration while erecting barriers to follower competition

- Predictive advantage dashboard providing real-time validation of market emergence hypotheses, enabling dynamic strategy adjustment as conditions evolve and maintaining temporal advantage over slower-moving competitors

- De-risked financial projections based on causal models rather than extrapolated assumptions, providing realistic growth trajectories and capital requirement forecasts that eliminate the catastrophic overconfidence endemic to traditional market entry planning

The System Linkage (The Integration Moat)

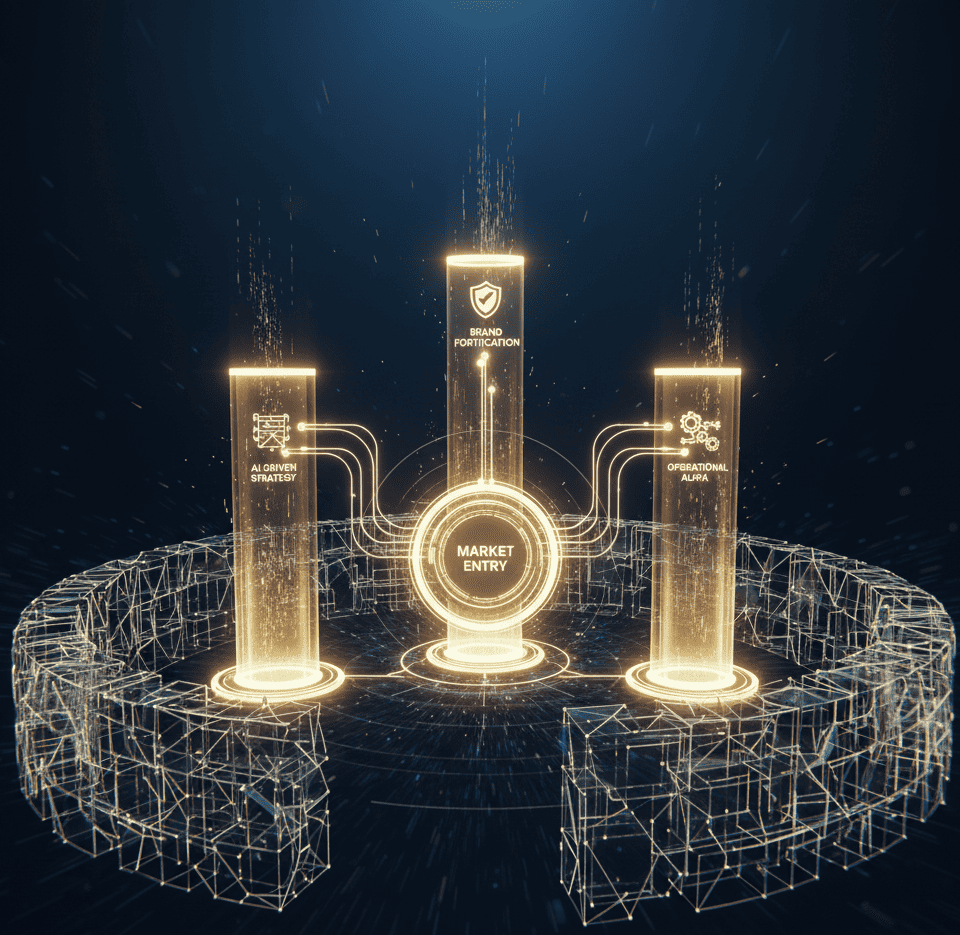

Market Entry achieves Asymmetric Growth only when integrated with the full Elevion system—isolated market expansion executed without the supporting architecture of AI-Driven Strategy, Brand Fortification, and Operational Alpha devolves into costly, linear competition regardless of market selection quality.

This capability is directly powered by the Causal Inference models from AI-Driven Strategy, which provide the predictive intelligence infrastructure that separates asymmetric opportunity from consensus saturation. Without continuous algorithmic scanning for emerging needs and competitive blind spots, market entry defaults to reactive pursuit of visible opportunities where informational advantage has already dissipated. The AI’s counterfactual modeling reveals not just which markets to enter, but when the window of asymmetric advantage opens and closes—enabling preemptive positioning that establishes category leadership before competitors recognize the opportunity exists. This temporal advantage is non-replicable through traditional market research, which by definition can only validate what already exists rather than predict what will emerge.

Market Entry requires the structural protection from Brand Fortification to establish pricing power immediately upon launch. Entering a new market without defensible brand architecture guarantees commoditization regardless of product superiority—competitors replicate your offering while undercutting on price, forcing a race to the bottom that destroys unit economics. Our Brand Fortification methodology hard-codes perceived value into your market entry strategy from day one, enabling premium positioning that captures disproportionate margin even in the early adoption phase. This is not aspirational branding; it is the systematic construction of structural differentiation that creates psychological switching costs and justifies pricing that reflects genuine value delivery rather than competitive parity.

The growth velocity promised by asymmetric market entry necessitates the scalable blueprints from Operational Alpha to ensure execution matches strategic ambition. The most predictively accurate market entry strategy fails catastrophically if organizational architecture cannot scale at the velocity the opportunity demands. Our Operational Alpha capability constructs the systematized infrastructure—customer onboarding sequences, fulfillment protocols, support systems, talent acquisition pipelines—required to capture market share before the window closes. This operational readiness is synchronized with market entry timing through our integrated system, eliminating the execution lag that allows competitors to neutralize first-mover advantage through superior operational execution despite later market entry.

The integration moat is strategic: Market Entry generates Asymmetric Growth only when predictive intelligence, brand defensibility, and operational scalability operate as a unified system. Fragmenting these capabilities across multiple vendors or executing them sequentially rather than simultaneously guarantees suboptimal outcomes—you either miss the timing window, enter without defensibility, or fail to scale fast enough to establish durable competitive advantage.

Engage the System

The most expensive strategic error founders make is not failed market entry—it is successful entry into the wrong markets. Executing flawlessly in consensus-driven opportunities generates linear returns that consume years of organizational focus and capital reserves while delivering outcomes indistinguishable from mediocrity. The opportunity cost is catastrophic: while you fight for incremental share in saturated categories, asymmetric vectors with exponential potential remain unexploited, and the temporal advantage windows that enable category leadership close permanently.

Asymmetric Growth does not result from superior execution in obvious markets—it concentrates among organizations that possess predictive intelligence infrastructure capable of identifying non-consensus opportunities before informational advantage dissipates. Every quarter you allocate resources toward consensus-validated markets is a quarter you forfeit the compounding returns available through strategic vectors only AI-driven causal inference can predict. The founders achieving disproportionate returns are not those with larger marketing budgets or better operational discipline—they are those who systematically exploit temporal asymmetries through predictive market entry.

The question is not whether you will expand—it is whether you will enter markets that reward your ambition with exponential returns or punish your effort with margin compression and competitive saturation. Traditional market entry analysis cannot answer this question because it optimizes for validation rather than prediction, consensus rather than asymmetry, visible opportunity rather than structural advantage. Elevion’s Market Entry capability replaces this compromised methodology with algorithmic certainty: the identification .

and exploitation of strategic vectors where limited competition, urgent unmet demand, and favorable structural dynamics create the conditions for category dominance rather than competitive parity.